[ad_1]

With open enrollment underway, Medicare beneficiaries have till December seventh to check and make a selection their protection for 2024. In addition they have a large number of choices to make a choice from, as two new KFF analyses display.

For plenty of beneficiaries, the primary determination is whether or not to sign up for conventional Medicare (steadily with supplemental protection and a stand-alone prescription drug plan) or Medicare Benefit, the personal plans subsidized through insurance coverage corporations that now quilt greater than part of all eligible Medicare beneficiaries.

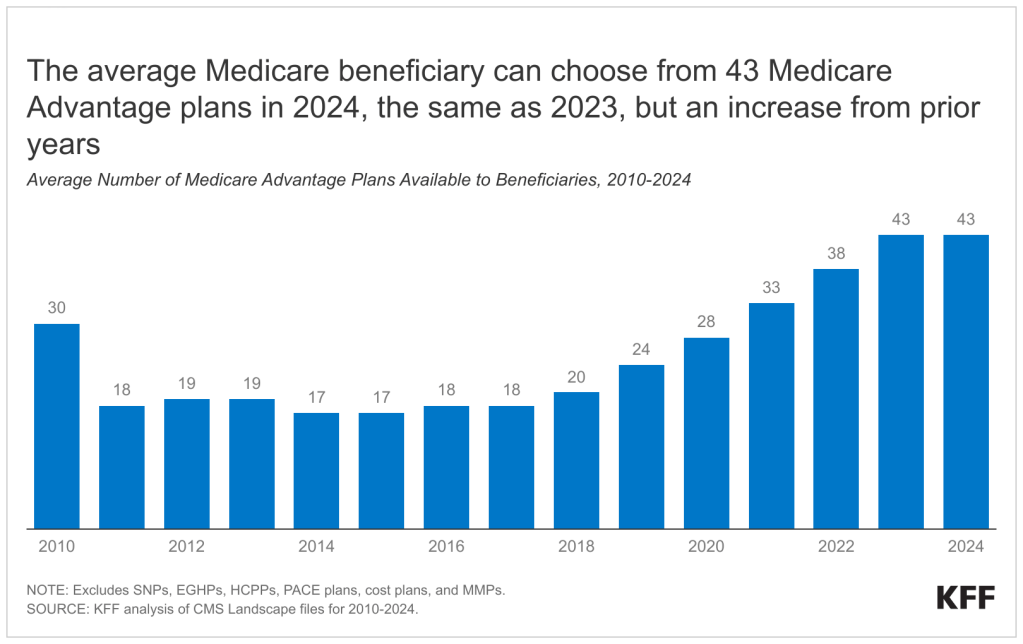

One new analysis presentations that the standard beneficiary has a collection of 43 Medicare Benefit plans as an alternative choice to conventional Medicare for 2024. That’s the similar quantity to be had as in 2023, however greater than double the collection of plans presented in 2018, which presentations how this marketplace is sexy to each enrollees and insurers.

As well as, the standard particular person coated underneath conventional Medicare can make a selection amongst 21 Medicare stand-alone prescription drug plans (PDPs), the second analysis shows. The collection of PDP choices for 2024 is decrease and the collection of Medicare Benefit prescription drug plan (MA-PD) choices is upper than in another yr since Section D began, reflecting the wider development towards Medicare Benefit.

New for 2024 in all Medicare Section D plans, each stand-alone PDPs and MA-PDs, is the removing of the 5% coinsurance requirement for catastrophic protection, a provision within the Inflation Aid Act that necessarily purposes as a brand new out-of-pocket restrict on Section D drug bills. That may translate into financial savings of hundreds of bucks for enrollees who take pricey medicine.

The 2 new analyses supply an summary of the Medicare Benefit and Medicare Section D market for 2024, together with the most recent information and key tendencies. Medicare’s open enrollment duration started Oct. 15 and runs thru Dec. 7.

Medicare Benefit

Just about 31 million Medicare beneficiaries—51% of all eligible beneficiaries—are enrolled in Medicare Benefit plans, which might be most commonly HMOs and PPOs presented through non-public insurers.

Of the 43 Medicare Benefit plans that the standard beneficiary can make a choice from of their native marketplace, 36 plans be offering Section D drug protection, on reasonable.

The typical Medicare beneficiary can make a choice from plans presented through 8 corporations in 2024, one fewer than in 2023.

Two-thirds (66%) of Medicare Benefit plans is not going to rate an extra top rate past Medicare’s same old Section B top rate in 2024, the similar as in 2023. As well as, 19% of Medicare Benefit plans will be offering some relief within the Section B top rate (sometimes called “a reimbursement”) in 2024, very similar to 2023.

In 2024, just about all plans (97% or extra) be offering some imaginative and prescient, health, listening to, or dental advantages as they’ve in earlier years, despite the fact that the scope of protection for those services and products varies.

Section D

In 2023, greater than part of all other folks with Medicare Section D protection (56%) are enrolled in Medicare Benefit plans and 44% in stand-alone drug plans.

Whilst the marketplace for Section D protection general stays powerful, for the typical beneficiary the collection of stand-alone drug plan choices for 2024 is decrease and the collection of Medicare Benefit plans with drug protection choices is upper than in another yr since Section D began. The overall collection of stand-alone drug plans (709) and companies providing those plans (11) have declined from 2023.

The research additionally presentations that, on reasonable, per thirty days premiums for drug protection are considerably upper for stand-alone plans in comparison to Medicare Benefit plans with drug protection. Whilst the typical top rate for stand-alone drug plans is projected to extend for 2024 for PDPs, it’s anticipated to stay strong for Medicare Benefit plans with drug protection.

Two-thirds of Section D stand-alone drug plan enrollees (with the exception of Low-Source of revenue Subsidy recipients)– with regards to 9 million enrollees–will see their per thirty days top rate building up in 2024 in the event that they keep of their present plan, whilst 4.4 million (34%) will see a top rate relief in the event that they keep of their present plan.

Beneficiaries who obtain Section D Low-Source of revenue Subsidies could have get right of entry to to fewer premium-free (benchmark) plans in 2024 than in any yr since Section D began. Because of adjustments in benchmark plan availability, an estimated 2.4 million LIS enrollees – part of all LIS enrollees in PDPs – wish to transfer plans right through the 2023 open enrollment duration in the event that they need to be enrolled in a premium-free benchmark plan in 2024.

Comparable Assets:

[ad_2]

Source link