[ad_1]

Medicare is the federal medical insurance program for other folks ages 65 and over and other folks underneath age 65 with long-term disabilities. This system is helping to pay for lots of hospital therapy products and services, together with hospitalizations, doctor visits, and prescribed drugs, together with post-acute care, professional nursing facility care, house well being care, hospice care, and preventive products and services.

Other people with Medicare would possibly select to obtain their Medicare advantages via conventional Medicare or via a Medicare Benefit plan, comparable to an HMO or PPO, administered by way of a personal well being insurer. Individuals who select conventional Medicare would possibly join a separate Medicare Phase D prescription drug plan for protection of outpatient prescribed drugs and may additionally believe buying a supplemental insurance coverage to lend a hand with out-of-pockets prices if they don’t have further protection from a former employer, union, or Medicaid. Individuals who go for Medicare Benefit can select amongst dozens of Medicare Benefit plans, which come with all products and services lined underneath Medicare Portions A and B, and incessantly come with Phase D prescription drug protection as smartly.

Every 12 months, Medicare beneficiaries have a chance to make adjustments to how they obtain their Medicare protection all over the just about 8-week annual open enrollment duration. This transient solutions key questions concerning the Medicare open enrollment duration and Medicare protection choices.

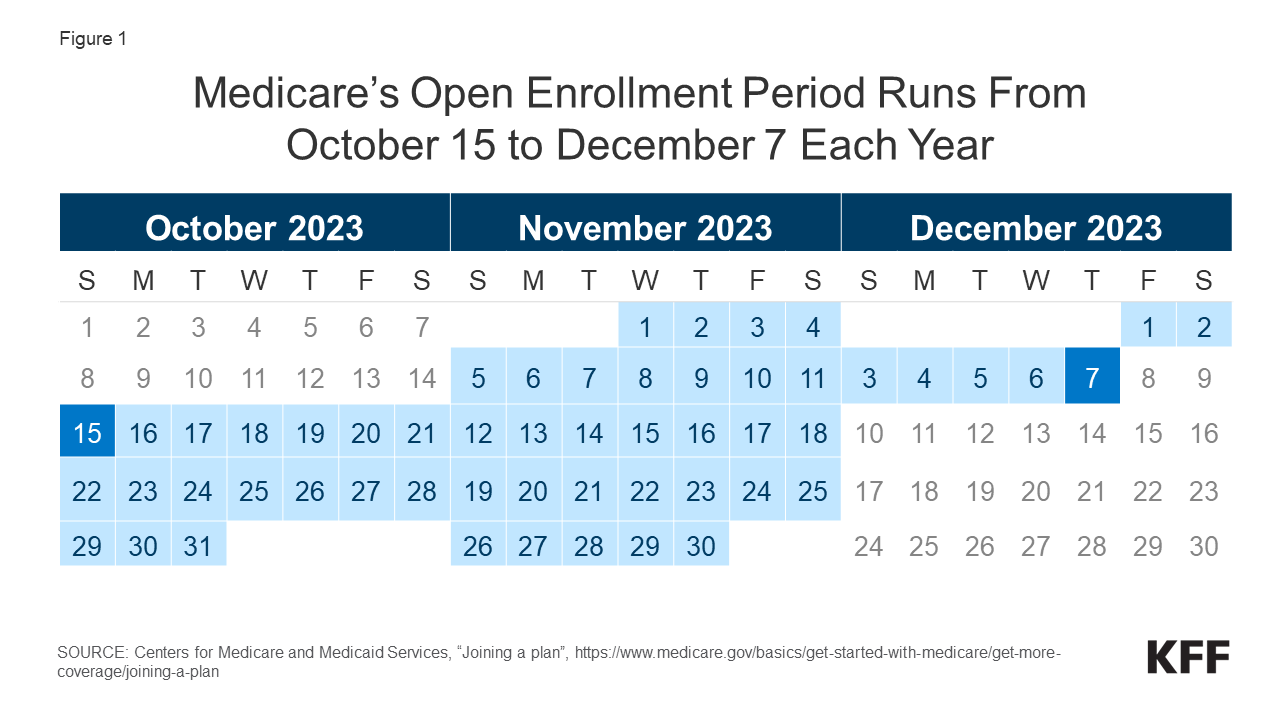

1. When is the once a year Medicare open enrollment duration?

The once a year Medicare open enrollment duration runs from October 15th to December 7th every 12 months (Determine 1). All over this time, other folks with Medicare can evaluation options of Medicare plans presented of their space and make adjustments to their Medicare protection, which move into impact on January 1st of the next 12 months. Those adjustments come with switching from conventional Medicare to a Medicare Benefit plan (or vice versa), switching between Medicare Benefit plans, and electing or switching between Medicare Phase D prescription drug plans.

2. What adjustments can Medicare beneficiaries make all over the once a year open enrollment duration?

Other people in conventional Medicare can use the Medicare open enrollment duration to join a Medicare Phase D prescription drug plan or transfer between Phase D plans. Conventional Medicare beneficiaries who didn’t join a Phase D plan all over their preliminary enrollment duration can sign up in a Phase D plan all over the once a year open enrollment duration, regardless that they could also be topic to a overdue enrollment penalty if they didn’t have related prescription drug protection from any other plan ahead of signing up for Phase D. Conventional Medicare beneficiaries with Medicare Portions A and B too can use this time to modify from conventional Medicare right into a Medicare Benefit plan, without or with Phase D protection.

People who find themselves enrolled in a Medicare Benefit plan can use the Medicare open enrollment duration to make a choice a distinct Medicare Benefit plan or transfer to standard Medicare. Medicare Benefit enrollees who transfer to standard Medicare can sign up in a Phase D plan if they would like outpatient prescription drug protection, which isn’t lined underneath Medicare Portions A and B. They may additionally believe buying a Medicare supplemental insurance coverage (Medigap) if the choice is to be had to them (see query 4 for information about Medigap and possible limits on enrollment).

Medicare beneficiaries are inspired to check their present supply of Medicare protection all over the once a year open enrollment duration and examine different choices which might be to be had the place they are living. As a result of a person’s clinical wishes can trade over the process the 12 months, and from 365 days to the following, this may increasingly affect their priorities when opting for how they need to get their Medicare advantages. Medicare Benefit and Medicare prescription drug plans normally trade from 365 days to the following and would possibly range in lots of ways in which will have implications for an individual’s get admission to to suppliers and prices. In spite of this, a KFF research of a nationally consultant survey of other folks with Medicare discovered that simplest one-third (32%) when put next their Medicare protection choices all over a up to date open enrollment duration (Determine 2).

3. Are there different alternatives for Medicare beneficiaries to make protection adjustments out of doors of the open enrollment duration?

Some Medicare beneficiaries can be certain adjustments to their protection at different occasions of the 12 months. As an example, beneficiaries who revel in disruptions to present protection (comparable to a cross-county transfer or a lack of employer- or union-sponsored protection) or adjustments in eligibility for Medicaid or different methods, would possibly qualify for a Special Enrollment Period at any time of 12 months. People who find themselves enrolled in each Medicare and Medicaid (i.e., dual-eligible people) or who qualify for the Medicare Part D Extra Help program, can trade their Medicare Benefit or Medicare Phase D protection as soon as in line with quarter. Other people residing in nursing houses and sure different amenities would possibly trade their Medicare Benefit or Medicare Phase D protection as soon as per thirty days.

Medicare Benefit enrollees who need to trade plans or transfer to standard Medicare would possibly accomplish that between January 1st via March 31st every 12 months, all over the Medicare Advantage Open Enrollment Period. (That is along with the open enrollment duration that runs from October 15th to December 7th.) Moreover, those that have a Medicare Benefit or Medicare Phase D plan with a 5-star high quality score to be had of their space would possibly switch into a 5-star plan between December 8th and November 30th of the next 12 months.

The once a year open enrollment duration and different alternatives to modify protection are distinct from the preliminary enrollment duration for people who find themselves newly enrolling in Medicare, which starts 3 months ahead of an individual’s 65th birthday and ends 3 months after it. For more info on preliminary enrollment, see the Medicare Open Enrollment FAQ.

4. How does supplemental protection, like Medigap and employer-sponsored retiree well being advantages, issue into Medicare protection choices?

Many Medicare beneficiaries have some type of additional coverage, comparable to a Medicare Supplemental Insurance plans (Medigap) or protection presented by way of an employer or a union, that is helping with Medicare’s cost-sharing necessities. Enrollment in those plans and methods isn’t tied to the open enrollment duration, regardless that beneficiaries would possibly need to take them into consideration when taking into consideration their choices for Medicare protection.

Medigap. Other people in conventional Medicare with each Phase A and Phase B can practice for a Medigap coverage at any time of the 12 months. Medigap insurance policies are designed to lend a hand beneficiaries in conventional Medicare with Medicare’s deductibles and cost-sharing necessities and feature usual advantages to permit for apples-to-apples comparisons throughout insurers. Conventional Medicare beneficiaries with a Medigap plan that covers maximum deductible and cost-sharing necessities will have decrease out-of-pocket spending for Medicare-covered products and services than other folks with different protection, together with a Medicare Benefit plan. Medigap insurance policies are designed to wrap round conventional Medicare, and don’t paintings with Medicare Benefit. Other people enrolled in Medicare Benefit do not need (and can’t buy) a Medigap coverage.

Whilst Medigap insurers are required to factor insurance policies to other folks age 65 or over, with out regard to well being standing or identified clinical prerequisites once they first sign up in Medicare, the ones with pre-existing prerequisites could also be denied a Medigap coverage or face upper premiums in most states in the event that they practice for Medigap protection after their first six months of enrollment in Phase B. Individuals who disenroll from Medicare Benefit inside of 365 days of first enrolling in Medicare Benefit have a proper to buy a Medigap coverage with out regard to clinical historical past, however after 365 days, they aren’t assured Medigap protection and could also be denied a coverage because of a pre-existing situation or face upper Medigap premiums if they’re presented a coverage.

Medigap assured factor rights are other for other folks underneath age 65 who qualify for Medicare because of long-term incapacity. Federal regulation does now not require Medigap insurers to promote a coverage to other folks with Medicare underneath age 65, even if several states do require insurers to offer at least one kind of Medigap policy to people under 65. Premiums for Medigap insurance policies bought to other folks underneath age 65 could also be upper than insurance policies bought to these age 65 or older. Other people underneath age 65 with disabilities who’re already enrolled in Medicare will qualify for the 6-month Medigap open enrollment duration once they flip 65 and turn into age eligible for Medicare. At this level, they are able to purchase any Medigap coverage they would like with out dealing with upper premiums or denials of protection according to their present clinical prerequisites.

Employer-sponsored protection. Whilst employer-sponsored retiree well being advantages are at the decline, greater than 15 million people with Medicare have retiree well being protection (distinct from other folks with Medicare Phase A simplest who proceed to paintings and feature medical insurance via their present employer or a partner’s present employer). Retiree well being advantages could also be designed to complement both conventional Medicare or Medicare Benefit. Some employers that provide advantages to retirees on Medicare be offering retiree well being advantages completely via a Medicare Benefit plan. Beneficiaries with retiree well being protection presented completely via a Medicare Benefit plan would possibly lose retiree well being advantages in the event that they select to modify to standard Medicare all over the once a year open enrollment duration. In a similar way, employers would possibly simplest be offering a retiree well being get advantages that dietary supplements conventional Medicare. If an individual with such protection switches from conventional Medicare to Medicare Benefit all over an open enrollment duration, they are going to lose their retiree well being advantages. Actually, if a Medicare beneficiary drops their employer or union-sponsored retiree well being advantages for any explanation why, they won’t be capable of get them again.

5. How does further strengthen for low-income other folks issue into Medicare protection choices?

Low-income Medicare beneficiaries who meet their states’ Medicaid eligibility standards qualify for added protection of products and services now not lined underneath Medicare, comparable to long-term products and services and helps. Moreover, Medicare beneficiaries with modest earning would possibly qualify for assistance with Medicare premiums and out-of-pocket costs from the Medicare Financial savings Methods (MSP) and Phase D Low-Source of revenue Subsidy (LIS) if their revenue and property are beneath sure quantities. Medicare beneficiaries who’re eligible for Medicaid, the Medicare Financial savings Methods, or Medicare Phase D Low-Source of revenue Subsidies, however now not but enrolled in those methods, can sign up at any time of the 12 months. This extra protection and help would possibly issue into how other folks select to obtain their Medicare advantages.

Medicaid. For individuals who qualify for complete Medicaid advantages, the number of Medicare protection can affect how they obtain the ones advantages and the level to which the ones advantages are coordinated with Medicare. Normally, Medicaid wraps round Medicare protection, with Medicare as the principle payer and Medicaid paying for prices and products and services now not lined by way of Medicare. Other people dually eligible for Medicare and Medicaid can sign up in a Medicare Benefit plan designed for this inhabitants, comparable to a dual-eligible particular wishes plan, and relying at the state and the plan, revel in a better stage of coordination in their advantages. Individuals who qualify for complete Medicaid advantages can transfer their Medicare protection out of doors of the open enrollment duration, as much as as soon as in line with quarter.

Medicare Financial savings Methods. State Medicaid methods pay Medicare premiums and, in lots of circumstances, charge sharing for Medicare beneficiaries who’ve revenue and property beneath sure quantities (which range by way of state). In particular, states duvet the Medicare Phase B top class for individuals who qualify and may additionally supply help with Medicare deductibles and different cost-sharing necessities. Individuals who obtain MSP help and are enrolled in a Medicare Benefit plan would possibly nonetheless have charge sharing related to non-Medicare lined products and services presented by way of the plan. Individuals who qualify for MSP too can transfer their protection out of doors of the open enrollment duration, as much as as soon as in line with quarter.

Phase D Low-Source of revenue Subsidy. Individuals who qualify for the Phase D Low-Source of revenue Subsidy (LIS) obtain various ranges of help towards their Phase D prescription drug protection premiums and value sharing, relying on their revenue and asset ranges. Twin-eligible people and other folks enrolled within the Medicare Financial savings Methods robotically qualify for complete LIS advantages, and Medicare robotically enrolls them right into a stand-alone Phase D drug plan of their space with a top class at or beneath the regional moderate (the Low-Source of revenue Subsidy benchmark) if they don’t select a plan on their very own. Different beneficiaries are topic to each an revenue and asset check and want to practice for the LIS via both the Social Safety Management or Medicaid. Individuals who obtain LIS help can choose any Phase D plan presented of their space, but when they sign up in a plan that’s not a so-called “benchmark plan” (this is, plans to be had and not using a top class to enrollees receiving complete LIS), or their present plan loses benchmark standing, they could also be required to pay some portion in their plan’s per 30 days top class, which might diminish the price of the subsidy.

6. How do the options of conventional Medicare examine to these of Medicare Benefit?

Conventional Medicare and Medicare Benefit each supply protection of all products and services incorporated in Medicare Phase A and Phase B, however sure options, comparable to out-of-pocket prices, supplier networks, and get admission to to additional advantages range between those two kinds of Medicare protection. When deciding between conventional Medicare and Medicare Benefit, other folks would possibly need to believe a lot of components, comparable to their very own well being and prescription drug wishes, monetary cases, personal tastes for a way they get their hospital therapy, and which suppliers they see. Those choices would possibly contain cautious attention of premiums, deductibles, charge sharing and out-of-pocket spending; additional advantages presented by way of Medicare Benefit plans; how the number of protection possibility would possibly have an effect on get admission to to sure physicians, experts, hospitals and pharmacies; regulations associated with prior authorization and referral necessities; and permutations in protection and prices for prescribed drugs.

Other people would possibly favor conventional Medicare if they would like the broadest conceivable get admission to to docs, hospitals and different well being care suppliers. Conventional Medicare beneficiaries would possibly see any supplier that accepts Medicare and is accepting new sufferers. Other people with conventional Medicare don’t seem to be required to procure a referral for experts or psychological well being suppliers. Moreover, prior authorization is never required in conventional Medicare and simplest applies to a limited set of services. With conventional Medicare, other folks find a way to make a choice amongst stand-alone prescription drug plans presented of their space, which generally tend to change extensively on the subject of which medication are lined and at what charge.

Other people would possibly favor Medicare Benefit if they would like additional advantages, comparable to protection of a few dental and imaginative and prescient products and services, and decreased charge sharing presented by way of those plans, incessantly for no further top class (rather then the Phase B top class). Moreover, Medicare Benefit plans are required to incorporate a cap on out-of-pocket spending, offering some coverage from catastrophic clinical bills. Medicare Benefit plans additionally be offering the good thing about one-stop buying groceries (i.e., individuals who sign up have protection underneath one plan and would not have to enroll in a separate Phase D prescription drug plan or a Medigap coverage to complement conventional Medicare).

7. How do Medicare Benefit plans range?

The typical Medicare beneficiary can make a choice from 43 Medicare Advantage plans (Determine 3) presented by way of 9 insurance coverage corporations in 2023. Those plans range throughout many dimensions, together with premiums and out-of-pocket spending, supplier networks, additional advantages, prior authorization and referral necessities, and prescription drug protection. Because of this, enrollees face other out-of-pocket prices, get admission to to suppliers and pharmacies, and protection of non-Medicare advantages (comparable to dental, imaginative and prescient and listening to) according to the Medicare Benefit plan they select.

Premiums and out-of-pocket spending. Medicare Benefit enrollees could also be charged a separate per 30 days top class (along with the Phase B top class). In 2023, the typical enrollment-weighted top class for Medicare Benefit plans used to be $15 per month, regardless that seven in ten enrollees have been in plans that charged no further top class (with the exception of the Phase B top class).

Medicare Benefit plans are typically prohibited from charging greater than conventional Medicare, however range within the deductibles, co-pays and co-insurance they require. As an example, plans normally rate a day-to-day co-pay for medical institution remains, which range each within the quantity and the choice of days for which they practice. A few of the 53 Medicare Benefit plans to be had in Philadelphia, PA in 2023, this quantity levels from $195 in line with day for as much as seven days to $450 an afternoon for as much as 4 days.

Medicare Benefit plans are required to incorporate a cap on out-of-pocket bills. In 2023, this cover won’t exceed $8,300 for in-network services or $12,450 for all covered services. Maximum plans have an out-of-pocket restrict beneath this cover, averaging $4,835 for in-network products and services and $8,659 for in-network and out-of-network products and services mixed. Out-of-pocket limits simplest practice to products and services lined underneath Medicare Portions A and B.

Supplier networks. Medicare Benefit plans are authorised to restrict their supplier networks, the dimensions of which will range significantly for each physicians and hospitals, relying at the plan and the county the place it’s presented. Medicare Benefit plans that come with prescription drug protection may additionally determine pharmacy networks or designate appreciated pharmacies, the place enrollees can have decrease out-of-pocket prices. If a Medicare Benefit plan supplies protection of out-of-network suppliers, it is going to require upper charge sharing from enrollees for those products and services.

Further advantages. Medicare Benefit plans would possibly select to supply additional advantages now not lined by way of conventional Medicare, comparable to some protection of dental, imaginative and prescient, and listening to products and services. Nearly all Medicare Benefit enrollees are in a plan that offers extra benefits, together with some protection of eye checks and/or eyeglasses (greater than 99%), listening to checks and/or aids (99%), a health get advantages (99%), and dental care (97%). Moreover, a majority of Medicare Benefit enrollees are in plans that offer an allowance for over the counter pieces (90%) and foods following a medical institution keep (78%). Whilst additional advantages are not unusual, the scope of protection varies extensively from plan to devise. As an example, in 2021, greater than part (59%) of Medicare Benefit enrollees have been in a plan with a maximum dental benefit of $1,000 or much less, whilst just about one-third (30%) have been in a plan with a restrict between $2,000 and $5,000.

Prior authorization and referral necessities. Medicare Benefit plans would possibly require enrollees to obtain prior authorization ahead of a carrier will likely be lined. In 2023, just about all Medicare Benefit enrollees have been in plans that required prior authorization for some products and services, comparable to inpatient medical institution remains, diagnostic checks and procedures, or remains in a talented nursing facility. Prior authorization can also be required for some products and services incorporated in a plan’s additional advantages, comparable to listening to and eye checks or complete dental products and services. As well as, Medicare Benefit plans would possibly require enrollees to procure a referral from a number one care supplier to be able to see a expert or mental health provider.

Prescription drug protection. Medicare Benefit enrollees who need prescription drug protection should select a plan that provides this protection, as they aren’t authorised to join a stand-alone prescription drug plan whilst enrolled in Medicare Benefit. Medicare Benefit plans that come with prescription drug protection may additionally rate a drug deductible, regardless that maximum don’t. In 2023, the typical drug deductible (together with plans and not using a deductible) used to be $58. Drug protection in Medicare Benefit plans varies alongside the similar dimensions as drug protection in stand-alone Phase D plans (described beneath).

8. How do Phase D plans range?

The typical Medicare beneficiary has 24 stand-alone Part D plans to choose between in 2023 (Determine 4) (along with a lot of Medicare Benefit drug plans, in the event that they need to believe Medicare Benefit for all in their Medicare-covered advantages). For normal Medicare beneficiaries who need to upload Phase D protection, stand-alone Phase D plans range on the subject of premiums, deductibles and value sharing, the medication which might be lined and any usage control restrictions that practice, and pharmacy networks. Those variations can have an effect on enrollees’ get admission to to prescribed drugs and out-of-pocket prices.

Premiums. Other people in conventional Medicare who’re enrolled in a separate stand-alone Phase D plan typically pay a per 30 days Phase D top class except they qualify for complete advantages during the Phase D Low-Source of revenue Subsidy (LIS) program and are enrolled in a premium-free (benchmark) plan. In 2023, the typical enrollment-weighted top class for stand-alone Phase D plans used to be $40 per month.

Deductibles and value sharing. Deductibles and cost-sharing necessities for prescription drug protection are variable. In 2023, maximum stand-alone Phase D plans incorporated a deductible, averaging $411. Plans typically impose a tier construction to outline charge sharing necessities and value sharing quantities charged. Plans normally rate decrease cost-sharing quantities for generic medication and appreciated manufacturers and better quantities for non-preferred and strong point medication, and rate a mixture of flat buck copayments and coinsurance (according to a share of a drug’s checklist value) for lined medication.

Medication lined and usage control restrictions. Phase D plans come with a listing of substances they duvet (additionally known as a plan’s formulary). As well as, plans may additionally impose usage control restrictions on lined prescribed drugs, together with prior authorization, amount limits, and step remedy, which will have an effect on beneficiaries’ get admission to to medicines. In 2023, round 30% of covered drugs are topic to prior authorization.

Pharmacy networks. Phase D prescription drug plans would possibly determine pharmacy networks or designate appreciated pharmacies, the place enrollees can have decrease out-of-pocket prices.

9. Do the Medicare prescription drug adjustments within the Inflation Relief Act range throughout Medicare protection choices?

No. The prescription drug provisions within the Inflation Reduction Act of 2022 that intention to decrease out-of-pocket prices practice to all Phase D plans, together with each stand-alone Phase D plans and Medicare Benefit Prescription Drug plans. Irrespective of whether or not beneficiaries get their drug protection from a stand-alone Phase D plan or a Medicare Benefit drug plan, they’re going to get pleasure from those adjustments.

As of 2023, charge sharing for insulin is now capped at $35 per thirty days in line with prescription. All Medicare Phase D plans, each stand-alone drug plans and Medicare Benefit drug plans, will likely be required to rate not more than $35 for whichever insulin merchandise they duvet, even if plans may not be required to hide all insulin merchandise. Beneficiaries who use a particular insulin product must examine protection in their product ahead of enrolling in a particular plan.

Additionally as of 2023, grownup vaccines lined underneath Medicare Phase D which have been really helpful by way of the Advisory Committee on Immunization Practices (ACIP) should now be lined without charge to enrollees. This alteration does now not affect the small choice of vaccines lined underneath Medicare Part B (such because the flu, pneumonia, and COVID-19 vaccines), lots of which have been already lined freed from charge. In the end, drug corporations at the moment are required to pay rebates to the Medicare program if the price of medication utilized by Medicare beneficiaries rises sooner than the velocity of inflation every 12 months, very similar to the rebate system utilized by the Medicaid program.

Further provisions will come into impact in the beginning of 2024, together with phasing in a cap on out-of-pocket prices for prescribed drugs lined underneath Medicare Phase D by way of getting rid of charge sharing above the catastrophic threshold in 2024 and environment the cap at $2,000 in 2025, and increasing eligibility for complete advantages underneath the Medicare Part D Low-Income Subsidy Program, which assists qualifying beneficiaries with their Phase D premiums, deductibles, and cost-sharing bills. Different adjustments to the Medicare Phase D program will likely be introduced in 2025 and beyond.

10. What sources are to be had to lend a hand Medicare beneficiaries in working out their protection choices?

Other people with Medicare can be told extra about Medicare protection choices and the options of various plan choices by way of reviewing the Medicare & You manual. As well as, other folks can evaluation and examine the Medicare choices to be had of their space by way of the use of the Medicare Plan Compare web site, a searchable software at the Medigare.gov web site, by way of calling 1-800-MEDICARE (1-800-633-4227), or by way of contacting their native State Health Insurance Assistance Program (SHIP). SHIPs be offering native, customized counseling and help to other folks with Medicare and their households. Touch data for state SHIPs will also be discovered by way of calling 877-839-2675 or by way of checking the list equipped at the Medicare.gov website.

Moreover, many of us use insurance coverage brokers and agents to navigate their protection choices. Whilst useful, brokers and agents are financially compensated by way of personal insurers for enrolling other folks of their plans, and often receive higher commissions if other folks select a Medicare Benefit plan moderately than last in conventional Medicare and buying a supplemental Medigap coverage and stand-alone Phase D plan.

[ad_2]

Source link