[ad_1]

In a recent post on his social media platform, Donald Trump claimed credit for lowering insulin copayments to $35 for “millions of Americans,” stating – inaccurately – that President Biden had “nothing to do with it.” This brief walks through the facts about actions taken under both the Trump and Biden Administrations related to capping insulin copayments for people with Medicare and explains the differences between their approaches.

What did the Trump Administration do?

In 2020, the Trump Administration established a voluntary, time-limited model under the Center for Medicare and Medicaid Innovation known as the Part D Senior Savings Model. Under this model, participating Medicare Part D prescription drug plans covered at least one of each dosage form and type of insulin product at no more than $35 per month. The model was in effect from 2021 through 2023, and less than half of all Part D plans chose to participate in each year.

What did the Biden Administration do?

In 2022, President Biden signed into law the Inflation Reduction Act, which included a provision that requires all Part D plans to charge no more than $35 per month for all covered insulin products, and also limits cost sharing for insulin covered under Part B to $35 per month. Deductibles no longer apply to insulins under Part D or Part B. These provisions took effect in 2023 (January 1 for Part D; July 1 for Part B).

What are the key differences between these approaches?

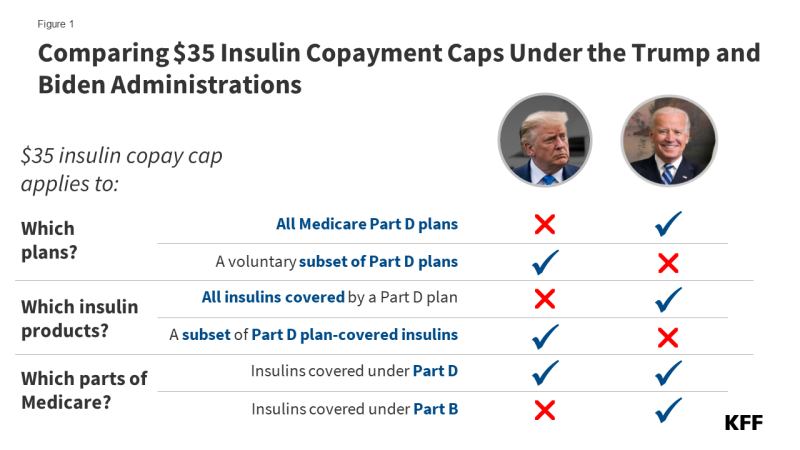

There are three key differences between these approaches (Figure 1):

- Applies to all Part D plans? The Trump Administration’s model relied on voluntary Part D plan participation, while the Biden Administration copay cap applies under all Part D plans. In 2022, a total of 2,159 Part D plans participated in the Trump Administration’s model, including both stand-alone prescription drug plans and Medicare Advantage drug plans, which is 38% of all Part D plans that year. Under the Inflation Reduction Act, the $35 copay cap is available in all 6,000 Part D plans available in 2024.

- Applies to all covered insulins in Part D? Under the Trump Administration’s model, participating plans were not required to cover all insulin products at the $35 monthly copayment amount, just one of each dosage form (vial, pen) and insulin type (rapid-acting, short-acting, intermediate-acting, and long-acting). Under the Biden Administration, the $35 copay cap in Part D extends to all insulin products that a Part D plan covers.

- Part D and Part B? The Trump Administration’s model applied only to insulin covered under Part D. The Biden Administration copay cap applies to insulins covered under both Part D and Part B.

While Trump claimed that he extended lower insulin pricing to “millions of Americans,” CMS estimates that around 800,000 insulin users had access to $35 insulin copays under the Part D Senior Savings Model in 2022. In contrast, the $35 copay cap under President Biden’s Inflation Reduction Act provision is available to all insulin users enrolled in all Medicare Part D plans – an estimated 3.3 million in 2020, based on KFF estimates – as well as those who take insulins covered under Part B.

The Trump Administration’s $35 insulin copay model had a more limited reach than the insulin copay cap now in place under the Inflation Reduction Act that President Biden signed into law, because the model was voluntary and because Part D plans could select which of their covered insulin products they wanted to make available at the $35 monthly copay. Under the insulin copay cap that took effect under the Inflation Reduction Act, insulin users in all Part D plans pay no more than $35 per month for any insulin product covered by their Part D plan.

What the November election could mean for people who need insulin

President Biden has proposed to extend the $35 monthly cap on insulin out-of-pocket costs to people with commercial insurance. The Biden Administration and Senate Democrats included a similar provision in the Inflation Reduction Act, but that provision was stripped from the final legislation after the vast majority of Republicans voted to remove it. According to KFF analysis, more than 1 in 4 insulin users in the individual and small group markets and about 1 in 5 insulin users with large employer coverage paid, on average, more than $35 per month out-of-pocket for insulin in 2018.

The House Republican Study Committee proposed a full repeal of the Inflation Reduction Act in its FY2025 budget proposal. While it is unclear whether Trump supports repealing this law in its entirety, doing so would eliminate the $35 insulin copay cap for millions of insulin users with Medicare and leave in its place only voluntary efforts offered by the three major insulin manufacturers, which apply to many people irrespective of their health coverage.

[ad_2]

Source link