[ad_1]

The states with the fastest recent growth in ACA Marketplace signups also had among the highest uninsured rates previously, as enhanced subsidies helped to make coverage more affordable for many consumers, particularly in southern states that did not expand their Medicaid programs to cover low-income adults, a new KFF analysis finds.

The enhanced premium subsidies were first provided in the American Rescue Plan Act in 2021 and then extended through 2025 in the Inflation Reduction Act.

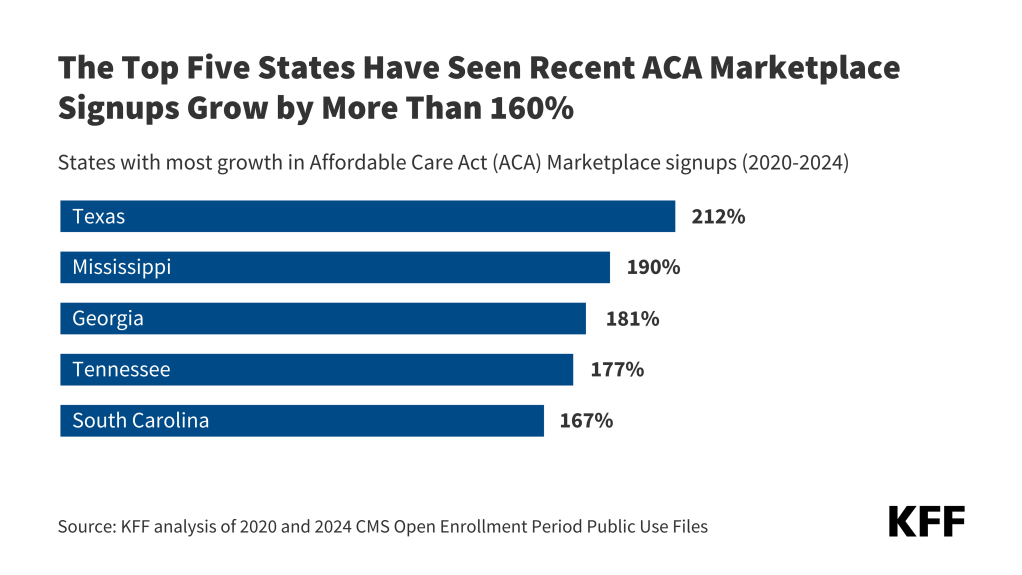

Marketplace enrollment has more than doubled in 15 states since 2020, including in Texas, where signups more than tripled (growing by 212%). On average, states that started out with nonelderly uninsured rates below 10% in 2019 saw an average of 31% growth in ACA Marketplace enrollment, while states with uninsured rates of 10% or more saw an average growth of 136% from 2020 to 2024.

None of the five states with the largest growth in recent ACA marketplace enrollment – Texas, Mississippi, Georgia, Tennessee, and South Carolina – have expanded Medicaid.

States that have not expanded their Medicaid programs under the ACA have seen their Marketplaces grow by 152% on average since 2020, compared to 47% average growth in expansion states. This reflects, in part, that many low-income people who would be eligible for Medicaid if they lived in expansion states are instead able to sign up for Marketplace coverage in non-expansion states without having to pay a premium.

Growth in ACA Marketplace enrollment in recent years also correlates with the type of enrollment platform, with states using Healthcare.gov seeing ACA Marketplace enrollment growing by 126% on average from 2020 to 2024, compared to 22% growth in states using state-run enrollment websites. This difference in growth could be explained in part by states’ differing starting points. States that use their own platforms are more likely to have made earlier and more consistent investments in outreach and marketing, and some had state-funded subsidies before the federal government’s enhanced subsidies. Additionally, states using Healthcare.gov have an option for brokers to enroll Marketplace customers directly without visiting the exchange website, which could have helped boost enrollment in states using the federal platform.

[ad_2]

Source link