[ad_1]

Employer- and union-sponsored retiree health benefits have served as an important source of supplemental coverage for people on Medicare. Retiree health plans have helped fill the gaps in Medicare’s benefit design by filling in some or all of Medicare’s deductibles and cost-sharing requirements and offering benefits that are not covered by traditional Medicare, such as dental and vision and a cap on out-of-pocket spending.

For the past 25 years, KFF has tracked trends in employer-sponsored coverage, including retiree health benefits. KFF’s 2023 employer survey shows a drop in the share of large employers (with 200 or more employees) offering health benefits to their retirees from 29% in 2020 to 21% in 2023, down from 66% in 1988. Among large employers that still offer retiree health benefits to Medicare-age retirees, KFF’s survey reveals a substantial rise in the share doing so through Medicare Advantage plans in recent years. Today, about 5 million Medicare-age retirees get their Medicare and supplemental retiree benefits from a group Medicare Advantage plan, according to KFF’s separate analysis of Medicare Advantage enrollment data.

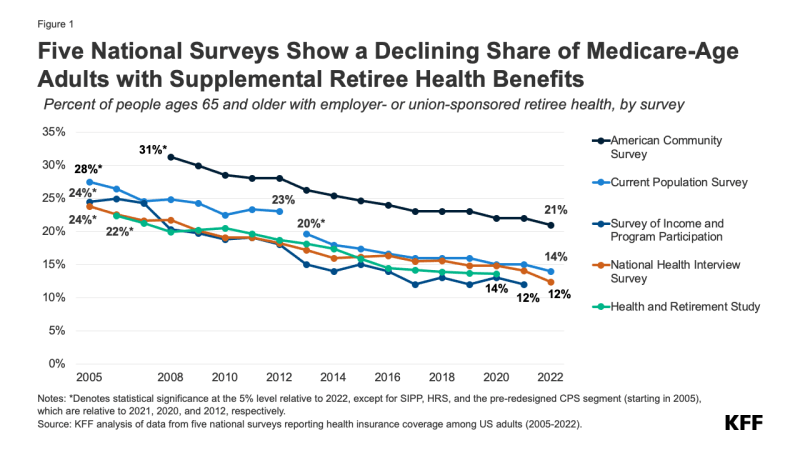

This data note analyzes five national surveys to assess trends in retiree health coverage among people ages 65 and older (Figure 1). These five surveys produce somewhat different estimates of retiree health coverage, but together paint a clear picture: the share of Medicare-age adults with employer- or union-sponsored retiree health coverage has been shrinking and appears to be on the way to extinction.

Estimates of the share of people ages 65 and older with retiree health benefits in 2022 vary across the five surveys, ranging from 21% (American Community Survey) to 12% (National Health Interview Survey). These differences are likely due to variations in sample size, differences in question wording, skip patterns and sample population (See Methods). As with the estimates for 2022, the trend lines also vary. For example, the American Community Survey shows the share declining from 31% in 2008, while the National Health Interview Survey shows the share declining from 22% in 2008 that year.

Retiree health benefits appear to be heading toward extinction for a number of reasons. The rise in health care costs has put pressure on employers to make tradeoffs between providing benefits to active workers versus retirees, accelerating this trend. Union membership has steadily declined over the past few decades, easing the pressure on employers to provide retiree benefits. And the demand for retiree benefits may be less intense than it once was because Medicare benefits have improved somewhat over the years, with the prescription drug benefit that was added in 2006 and the offer of some extra benefits for beneficiaries who choose to enroll in a Medicare Advantage plan.

The erosion of retiree health coverage, given the high cost of health care and the modest incomes and assets of a large share of the Medicare population, heightens the importance of Medicare coverage decisions for retiring boomers and their spouses, and the importance of addressing the challenges facing Medicare’s future. Across each of these national surveys, retiree benefits seem to be going, going and may soon be gone.

Methods

This data note is based on an analysis of five national surveys. The analysis of the Current Population Survey cannot be trended to years prior to 2013 due to improvements made by the U.S. Census Bureau to the Health Insurance Questionnaire of the Current Population Survey between 2012 and 2013. This analysis does not include data from the Medicare Current Beneficiary Survey due to methodological changes that are likely to impact coverage assignment and trends.

Differences reported in the paper and in the figure denote statistical significance at the 5% level relative to 2022, except for SIPP, HRS, and the pre-redesigned CPS segment (starting in 2005), which are relative to 2021, 2020, and 2012, respectively. The numbers displayed show the percent of retired people ages 65 and older who are holding employer-sponsored insurance (ESI) from any source, except for those in the ACS, which depicts the percent of people ages 65 and older not in the labor force who are holding ESI from any source.

All surveys provide annual estimates, except for SIPP, which provides data monthly; all depicted SIPP data are from September of the given year. HRS data are provided every two years (even-numbered years).

Tricia Neuman is with KFF. Anthony Damico is an independent consultant.

[ad_2]

Source link