[ad_1]

There were quite a lot of federal movements to handle excessive prescription drug prices lately, together with the passage of the Inflation Reduction Act, proposed legislation to control pharmacy get advantages managers (PBMs), and a brand new proposed federal rule with provisions that building up value transparency. State officers additionally remain concerned concerning the emergence of latest, excessive charge medicine and proceed to enforce quite a lot of charge containment projects. On the similar time, the beginning of the COVID-19 pandemic and the pandemic-related continuous enrollment provision significantly affected Medicaid enrollment and spending trends. States have now begun to “unwind” the continual enrollment provision which is predicted to additional impact Medicaid enrollment and spending, even supposing substantial uncertainty stays associated with how Medicaid enrollment will exchange over the process the unwinding. This factor transient describes contemporary nationwide Medicaid prescription drug usage and spending developments, examines how the pandemic can have impacted the ones developments, and explores what contemporary developments may imply as states unwind the continual enrollment provision and proceed to take care of new, high-cost medicine coming into the marketplace. Key findings come with:

- Even supposing Medicaid enrollment reached ancient ranges all the way through the continual enrollment duration, Medicaid prescription drug usage remained underneath FY 2017 ranges thru FY 2022.

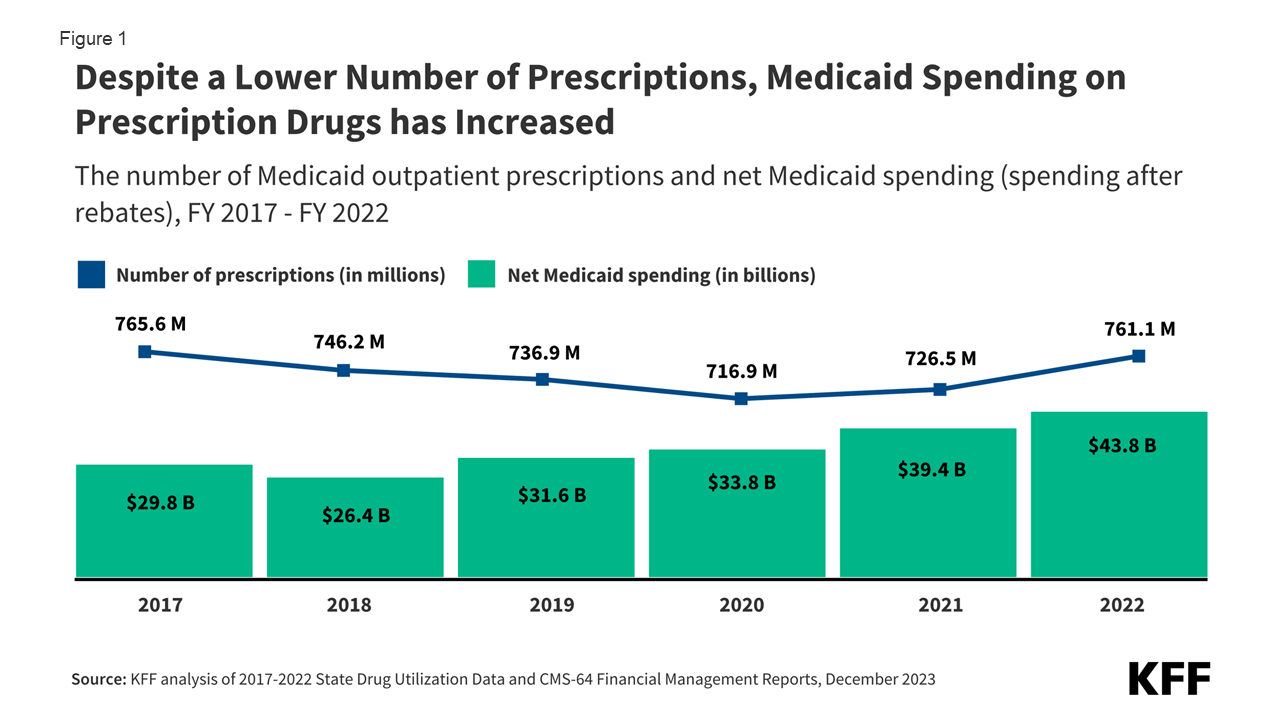

- Web spending (spending after rebates) on Medicaid prescribed drugs is estimated to have grown lately, expanding from $29.8 billion in FY 2017 to $43.8 billion in FY 2022, a 47% building up.

- In spite of decrease usage, Medicaid spending on prescribed drugs has greater, and each states and the government proceed to do so to battle emerging prices (Determine 1).

Determine 1: In spite of a Decrease Collection of Prescriptions, Medicaid Spending on Prescription Medication has Larger

Usage Developments

Even supposing Medicaid enrollment reached ancient ranges all the way through the continual enrollment duration, Medicaid prescription drug usage remained underneath FY 2017 ranges thru FY 2022 (Determine 2). After peaking in FY 2017, Medicaid outpatient prescription drug usage started to decline, even prior to the COVID-19 pandemic. Usage declined through 3% in FY 2020, the primary yr of the pandemic, prior to starting to building up once more in FY 2021 (through 1%) and FY 2022 (through 5%). In spite of contemporary will increase, the entire choice of Medicaid prescriptions in FY 2022 (761.1million) remained underneath FY 2017 ranges (765.6 million). On the similar time, enrollment in Medicaid and the Kids’s Well being Insurance coverage Program (CHIP) grew considerably following the onset of the pandemic, peaking at 94.5 million other people in April 2023 – an building up of 23.1 million enrollees or 32.4% from February 2020. The choice of Medicaid prescriptions consistent with individual has declined since FY 2020, pointing to decrease drug usage amongst the ones folks enrolled all the way through the continual enrollment provision.

Spending Developments

Web spending (spending after rebates) on Medicaid prescribed drugs is estimated to have grown lately, expanding from $29.8 billion in FY 2017 to $43.8 billion in FY 2022, a 47% building up (Determine 3). Gross Medicaid spending (spending prior to rebates) on outpatient prescribed drugs has additionally grown since 2017, expanding from $64.7 billion in FY 2017 to $92.3 billion in 2022. The adaptation between internet and gross spending is drug rebates. Underneath the Medicaid Drug Rebate Program, drug producers supply rebates to the government and states in change for Medicaid protection in their medicine, and a Congressional Finances Place of business study discovered those rebates lead to decrease internet drug costs in Medicaid in comparison with different federal systems. Enlargement in rebates on Medicaid prescribed drugs was once slower than gross spending expansion over the duration, with rebates expanding from $34.9 billion to $48.5 billion, or 39%, from FY 2017 to FY 2022.

Each gross and internet prescription drug spending have greater annually beginning in FY 2019, regardless of the onset of the pandemic and usage declines thru FY 2020, most likely pushed through increased spending on high-cost emblem medicine. General, internet Medicaid spending consistent with prescription greater from $39 in 2017 to $58 in 2022. Research have discovered considerable drug price increases past the speed of inflation lately in addition to expanding launch prices for brand new medicine. On the other hand, internet Medicaid spending on prescribed drugs total accounted for five.6% of overall Medicaid spending in FY 2022, just a slight building up from FY 2017 (5.2%).

Rebates scale back Medicaid spending on prescribed drugs through over part, however the lower is bigger for fee-for-service (FFS) drug spending (Determine 4). Over the duration, the proportion of gross spending rebates accounted for held quite secure, round a median of 54% of gross Medicaid spending (Determine 3). Rebates are usually a lot upper for emblem medicine in comparison with generic medicine. A MACPAC analysis of FY 2020 knowledge discovered statutory rebates have been round 61.6% of gross spending on emblem medicine however 8.6% of gross spending on generic medicine. In 2022, drug rebates comprised 65% of gross FFS spending however simplest 46% of gross controlled care group (MCO) spending. There are a number of conceivable causes for that distinction:

- One study discovered the construction of the rebate program might incentivize using generic or decrease priced medicine in MCOs since MCOs don’t obtain statutory rebates. States do obtain a portion of statutory rebates (which might be usually upper for emblem medicine), so there could also be muted incentive to shift to generics in FFS.

- Some states additionally carve out particular medicine or drug categories from controlled care, usually focused on high-cost, emblem medicine (that have upper rebates).

- Whilst capitated controlled care is now the predominant supply device for Medicaid in maximum states, controlled care penetration charges for various eligibility teams can vary through state. Adults ages 65+ and other people eligible thru incapacity are much less likely to be enrolled in MCOs and might require extra strong point emblem medicines which usually have upper rebates.

- This research does no longer come with any supplemental rebates that can be negotiated between controlled care plans and producers, however does come with supplemental rebates negotiated between state Medicaid companies and producers.

What to Watch Having a look Forward?

Whilst the COVID-19 pandemic had a vital have an effect on on Medicaid enrollment, nationwide Medicaid prescription drug usage was once quite unaffected. In spite of ancient will increase in Medicaid enrollment over the last 3 years, prescription drug usage in Medicaid remained underneath FY 2017 ranges. The choice of prescriptions consistent with individual declined all the way through the pandemic, indicating decrease drug usage amongst the ones folks enrolled in Medicaid all the way through the continual enrollment provision. As states unwind the continual enrollment provision, tens of millions are expected to lose their Medicaid protection, which might have an effect on long term drug usage developments relying on how a lot enrollment declines and the way the well being wishes of the ones ultimate at the program exchange. Whilst nationwide usage developments might stay quite strong as they’ve lately, lack of Medicaid protection on a person degree can have critical penalties for many who depend on common get admission to to prescribed drugs. A recent KFF center of attention team record discovered that individuals mentioned that dropping Medicaid can be “devastating” because of lack of get admission to to “lifesaving” prescriptions and coverings.

In spite of decrease usage, Medicaid spending on prescribed drugs has greater, and each states and the government proceed to do so to battle emerging prices (Determine 4). On the federal degree, there were contemporary expenses into account with Medicaid drug pricing provisions or implications for Medicaid drug spending. As well as, CMS issued a proposed rule with provisions that might building up transparency of PBM contracts and supply pricing knowledge on sure high-cost medicine, and the Biden management lately threatened to clutch patents for medicine advanced with govt analysis investment from producers if a drug’s value is just too excessive and make allowance different drug corporations to promote the drug. The Inflation Aid Act, handed in 2022, aims to considerably scale back Medicare prescription drug spending, regardless that one of the most provisions interact with the Medicaid Drug Rebate Program and might result in will increase in Medicaid prescription drug spending. Additional, all states have adopted no less than one regulation to control PBMs, and Congress has additionally proposed legislation to handle PBM unfold pricing and building up transparency, together with the lately Area handed Lower Costs, More Transparency Act. In KFF’s annual survey of state Medicaid systems, states famous emerging prescription drug prices have been an ongoing problem, with over two-thirds of states reporting new or expanded projects to comprise prescription drug prices, a lot of which center of attention on mitigating the associated fee have an effect on of doctor administered and/or biologic medicine. As new, pricey medicine proceed to emerge, together with a brand new team of extremely efficient weight-loss agents, each states and the government will proceed to take care of the budgetary have an effect on of those medicine and expand insurance policies to handle them.

| Usage and Gross Spending Knowledge: This research makes use of 2016 thru 2022 State Drug Utilization Data (SDUD) (downloaded in December 2023) transformed to federal fiscal yr (FY) 2017 thru FY 2022. The SDUD is publicly to be had knowledge supplied as a part of the Medicaid Drug Rebate Program (MDRP), and offers knowledge at the choice of prescriptions, Medicaid spending prior to rebates, and cost-sharing for rebate-eligible Medicaid outpatient medicine through NDC, quarter, controlled care or fee-for-service, and state. It additionally supplies this knowledge summarized for the entire nation. CMS has suppressed SDUD cells with fewer than 11 prescriptions, bringing up the Federal Privateness Act and the HIPAA Privateness Rule. This research used the nationwide totals knowledge as a result of much less knowledge is suppressed on the nationwide as opposed to state degree.

Rebate Knowledge: This research makes use of CMS-64 Financial Management Reports (FMR) for FY 2017 thru FY 2022 (downloaded in November 2023). Those reviews come with overall Medicaid expenditures damaged out through quite a lot of provider classes, and this research pulls out the drug rebate line items, isolating them through controlled care or fee-for-service rebates. The rebate knowledge used contains statutory rebates, state supplemental rebates, rebates below the ACA offset, and rebates for opioid use dysfunction medicine assisted remedy. Supplemental rebate agreements negotiated between Medicaid controlled care plans and producers don’t seem to be incorporated. The rebates accrued within the CMS-64 have been subtracted from the gross spending totals from the SDUD to estimate internet Medicaid spending on prescribed drugs every fiscal yr. Boundaries: There are a couple of boundaries to the estimates of Medicaid usage and spending discovered on this research, together with:

|

[ad_2]

Source link