[ad_1]

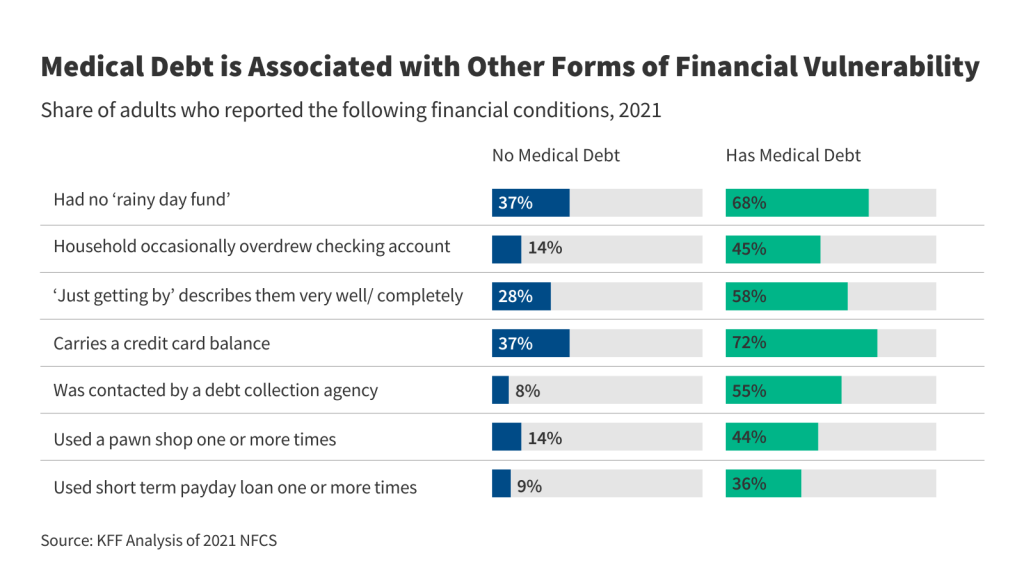

Folks with clinical debt are a lot more most probably than the ones with out such debt to turn different indicators of economic vulnerability, like having no “wet day” fund, overdrawing a bank account, or depending on pricey loans, in keeping with a new KFF analysis of nationwide survey information.

Scientific debt stays a serious problem within the U.S., together with amongst other people with medical insurance. In 2021, 23% of U.S. adults had a number of unpaid and overdue expenses from a clinical provider supplier.

KFF’s 2022 Health Care Debt Survey discovered equivalent effects: Amongst adults, 24% say they’d clinical or dental expenses that had been overdue or that they might no longer pay, and a complete of 41% had some form of well being care debt, together with on bank cards or owed to members of the family.

Scientific debt and different sorts of monetary instability have an effect on other people and families around the source of revenue spectrum and will reason folks to forgo wanted care. In its award-winning sequence, “Diagnosis: Debt”, KFF Well being Information tested the epidemic of clinical debt that has grow to be a defining characteristic of the U.S. well being care device.

The Client Monetary Coverage Bureau is predicted to unencumber necessities that take away clinical debt from credit score experiences and may crack down on sure debt assortment practices. Some states and localities have additionally purchased or are in search of to shop for their citizens’ clinical debt, partly with last COVID reduction finances.

KFF’s new research depends on information from the 2021 Nationwide Monetary Features Survey. The survey makes use of knowledge from greater than 27,000 adults in each and every state and D.C.

[ad_2]

Source link