[ad_1]

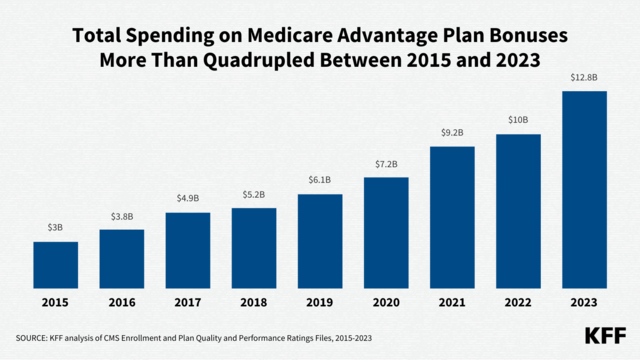

Federal spending on bonus bills to insurance coverage firms that provide Medicare Benefit plans will succeed in a minimum of $12.8 billion in 2023, in keeping with a new KFF analysis. That could be a just about 30% building up from 2022, and greater than quadruple the spending in 2015.

Those information come from certainly one of 3 analyses launched these days via KFF that read about more than a few sides of the Medicare Benefit program, which supplies medical insurance protection to just about 31 million American citizens. KFF tested traits in enrollment, premiums, out-of-pocket limits, charge sharing, supplemental advantages, prior authorization, megastar scores and bonus bills.

Bonus bills, that have been established via the Inexpensive Care Act, are in keeping with a five-star ranking machine and are meant to inspire Medicare Benefit plans to compete for enrollees in keeping with high quality. The bills range considerably throughout companies, with UnitedHealthcare receiving the biggest overall bills ($3.9 billion) and Kaiser Permanente the best cost consistent with enrollee ($523).

80-five p.c of Medicare Benefit enrollees are in plans which are receiving bonus bills in 2023. The have an effect on of megastar scores on bonus bills lags a 12 months, and several other insurance policies in position all the way through the COVID-19 Public Well being Emergency have expired, decreasing 2023 megastar scores relative to 2022, which can most probably result in a smaller proportion of enrollees in plans that obtain bonuses within the 2024 plan 12 months.

Enrollment in Medicare Benefit in 2023 incorporates greater than 51% of the eligible Medicare inhabitants — greater than two times the percentage enrolled in 2007 (19%), as famous in a companion analysis that gives the most recent details about Medicare Benefit enrollment, via plan kind and company, and displays how enrollment varies via state and county.

Enrollment remains to be extremely concentrated amongst a handful of companies, with UnitedHealthcare (29%) adopted via Humana (18%), comprising just about part of all Medicare Benefit enrollees national, in keeping with the research. Blue Pass Blue Defend (BCBS) associates (together with Anthem BCBS plans) account for any other 14%. And 4 different companies (CVS Well being, Kaiser Permanente, Centene, and Cigna) account for any other 23%.

Additional research launched via KFF these days displays that 73% of Medicare Benefit enrollees are in plans with prescription drug protection (MA-PDs) that require no top rate rather then the Medicare Section B top rate. KFF additionally paperwork that nearly all of enrollees in Medicare Benefit plans have get right of entry to to a couple advantages now not lined via conventional Medicare, corresponding to eye assessments and/or glasses, listening to assessments and/or aids, a health receive advantages, dental care, and diminished cost-sharing.

Plans are ready to supply those additional advantages, ceaselessly for no further top rate, in large part because of the present Medicare cost machine that gives an extra $2,350 consistent with enrollee above plans’ estimated prices of offering Medicare-covered services and products, on moderate.

One tradeoff of enrolling in Medicare Benefit is that many plans mechanically require sufferers to procure prior authorization for services and products. Nearly all Medicare Benefit enrollees (99%) are in plans that require authorization for some services and products, in keeping with the research.

For more info, please consult with:

[ad_2]

Source link