[ad_1]

Other people with Medicare have the ability of receiving their Medicare advantages during the conventional Medicare program administered via the government or via a personal Medicare Benefit plan, similar to an HMO or PPO. In Medicare Benefit, the government contracts with personal insurers to offer Medicare advantages to enrollees. Medicare can pay insurers a collection quantity according to enrollee monthly, which varies relying at the county wherein the plan is positioned, the well being standing of the plan’s enrollees, and the plan’s estimated prices of protecting Medicare Phase A and Phase B services and products. The plans use those bills to pay for Medicare-covered services and products, and normally, additionally pay for added advantages and decreased charge sharing. Plans are required to fulfill federal requirements, together with offering an out-of-pocket prohibit. Medicare Benefit plans also are authorized to restrict supplier networks, and would possibly require prior authorization for positive services and products, topic to federal necessities.

This temporary supplies details about Medicare Benefit plans in 2023, together with premiums, charge sharing, out-of-pocket limits, supplemental advantages, prior authorization, and famous person scores, in addition to traits over the years. A companion analysis examines traits in Medicare Benefit enrollment.

Key highlights come with:

- In 2023, greater than 7 in 10 (73%) enrollees in person Medicare Benefit plans with prescription drug protection pay no top rate instead of the Medicare Phase B top rate, which is a large promoting level for beneficiaries.

- Maximum Medicare Benefit enrollees have get right of entry to to advantages that don’t seem to be lined via conventional Medicare, similar to imaginative and prescient, listening to and dental. Plans are in a position to provide further advantages as a result of they’re paid $2,350 according to enrollee, on reasonable, above their estimated prices of offering Medicare-covered services and products (referred to as “the rebate”). The rebate has larger considerably within the ultimate a number of years, greater than doubling since 2018.

- Just about all Medicare Benefit enrollees (99%) are in plans that require prior authorization for some services and products, which is typically now not utilized in conventional Medicare. Medicare Benefit plans even have outlined networks of suppliers, against this to standard Medicare.

- Maximum Medicare Benefit enrollees are in plans with a high quality score of no less than 4 out of five stars, defined partially via the truth that more than half (51%) of plans obtain scores at or above this threshold.

In 2023, greater than 7 in 10 Medicare Benefit enrollees (73%) are in plans with out a supplemental top rate (instead of the Phase B top rate)

In 2023, the general public (73%) enrolled in person Medicare Benefit plans with prescription drug protection (MA-PDs) pay no top rate instead of the Medicare Phase B top rate ($164.90 in 2023) (Determine 1). The MA-PD top rate comprises each the price of Medicare-covered Phase A and Phase B advantages and Phase D prescription drug protection. In 2023, 97% of Medicare Benefit enrollees in person plans open for normal enrollment are in plans that supply prescription drug protection.

Altogether, together with those that don’t pay a top rate, the typical enrollment-weighted top rate in 2023 is $15 monthly, and averages $10 monthly for simply the Phase D portion of lined advantages, considerably not up to the typical top rate of $40 for stand-alone prescription drug plan (PDP) premiums in 2023. Upper reasonable PDP premiums in comparison to the MA-PD drug portion of premiums is due partially to the power of MA-PD sponsors to make use of rebate bucks from Medicare bills to decrease their Phase D premiums. When a plan’s estimated prices for Medicare-covered services and products are under the utmost quantity the government can pay personal plans in a space (referred to as the benchmark), the plan keeps a portion of the adaptation, referred to as the “rebate”. In keeping with the Medicare Fee Advisory Fee (MedPAC), rebates average over $2,300 per enrollee in 2023.

For the remainder 27% of beneficiaries who’re in plans with a MA-PD top rate (5.1 million), the typical top rate is $57 monthly, and averages $38 for the Phase D portion of lined advantages – relatively not up to the $40 per thirty days PDP top rate.

Premiums paid via Medicare Benefit enrollees have declined since 2015.

In 2023, the typical enrollment weighted MA-PD top rate, together with amongst those that don’t pay a top rate, is $15 monthly. On the other hand, reasonable MA-PD premiums range via plan sort, starting from $14 monthly for HMOs to $17 monthly for native PPOs and $46 monthly for regional PPOs. Just about 6 in 10 Medicare Benefit enrollees are in HMOs (58%), 40% are in native PPOs, and a couple of% are in regional PPOs in 2023.

Reasonable MA-PD premiums have declined from $36 monthly in 2015 to $15 monthly in 2023. The aid is pushed partially via the decline in premiums for native PPOs and HMOs, that account for a emerging proportion of enrollment over this period of time.

Since 2015, a emerging proportion of plans estimate that their charge of offering Medicare Phase A and Phase B services and products (the “bid”) is under the utmost quantity that CMS can pay within the space the place the plan operates (the “benchmark”). The adaptation between bids and benchmarks permits plans to provide protection that normally comprises further advantages with out charging an extra top rate. As plan bids have declined, the rebate portion of plan bills has larger, and plans are allocating a few of the ones rebate bucks to decrease the phase D portion of the MA-PD top rate. This pattern contributes to bigger availability of zero-premium plans, which brings down reasonable premiums.

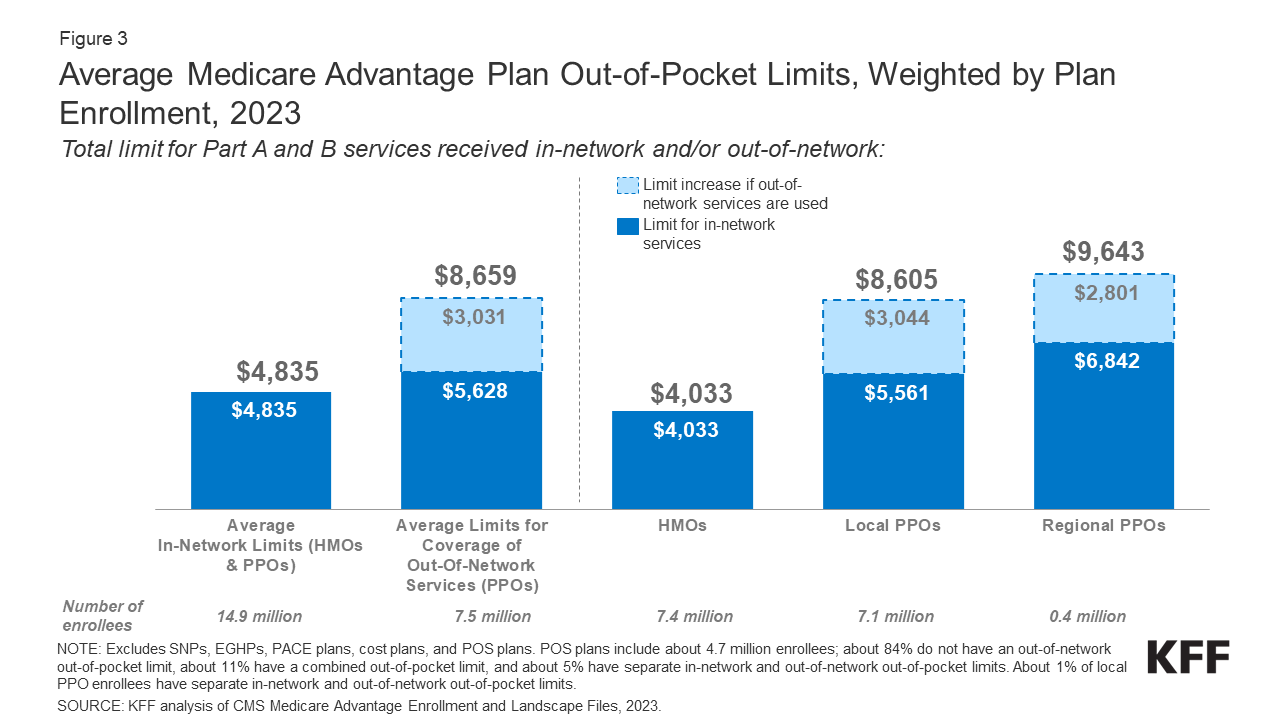

The common out-of-pocket prohibit for Medicare Benefit enrollees is $4,835 for in-network services and products and $8,659 for each in-network and out-of-network services and products (PPOs).

Since 2011, federal legislation has required Medicare Benefit plans to offer an out-of-pocket prohibit for services and products lined underneath Portions A and B. Against this, conventional Medicare does now not have an out-of-pocket prohibit for lined services and products.

In 2023, the out-of-pocket prohibit for Medicare Benefit plans would possibly not exceed $8,300 for in-network services and products and $12,450 for in-network and out-of-network services and products blended. Those out-of-pocket limits practice to Phase A and B services and products handiest, and don’t practice to Phase D spending, for which there is a separate out-of-pocket threshold of $7,400 in 2023, above which enrollees pay 5% of prices. (The 5% coinsurance requirement for Phase D enrollees within the catastrophic segment shall be eradicated beginning in 2024 as a part of the Inflation Reduction Act). Whether or not a plan has handiest an in-network cap or a cap for in- and out-of-network services and products relies on the kind of plan. HMOs typically handiest quilt services and products equipped via in-network suppliers, while PPOs additionally quilt services and products delivered via out-of-network suppliers however price enrollees upper charge sharing for this care. The dimensions of Medicare Benefit supplier networks for physicians and hospitals range very much each throughout counties and throughout plans in the similar county.

In 2023, the weighted reasonable out-of-pocket prohibit for Medicare Benefit enrollees is $4,835 for in-network services and products and $8,659 for in-network and out-of-network services and products blended. For enrollees in HMOs, the typical out-of-pocket (in-network) prohibit is $4,033 (Determine 3). Enrollees in HMOs are typically chargeable for 100% of prices incurred for out-of-network care. On the other hand, HMO level of sale (POS) plans permit out-of-network deal with positive services and products, although it normally prices greater than in-network protection. For native and regional PPO enrollees, the typical out-of-pocket prohibit for each in-network and out-of-network services and products is $8,605, and $9,643, respectively.

Determine 3: Reasonable Medicare Benefit Plan Out-of-Pocket Limits, Weighted via Plan Enrollment, 2023

The common out-of-pocket prohibit for in-network services and products has typically trended down from 2017, and the typical in-network prohibit reduced from $5,091 in 2021 to $4,835 in 2023. The common blended in- and out-of-network prohibit for PPOs reduced from $9,245 in 2022 to $8,659 in 2023.

Maximum Medicare Benefit enrollees, together with enrollees in particular wishes plans, have get right of entry to to a couple advantages now not lined via conventional Medicare in 2023

Nearly all enrollees in person Medicare Benefit plans (the ones typically to be had to Medicare beneficiaries) are in plans that supply get right of entry to to eye exams and/or glasses (greater than 99%), hearing exams and/or aids (99%), a health receive advantages (99%), telehealth services and products (98%), and dental care (98%) (Determine 4). In a similar way, maximum enrollees in SNPs are in plans that supply get right of entry to to those advantages. On the other hand, advantages similar to Phase B drug rebate are much less not unusual for enrollees in each person plans (10%) and SNPs (7%). This research excludes employer-group well being plans as a result of employer plans don’t put up bids, and to be had information on supplemental advantages will not be reflective of what employer plans in fact be offering.

Even though those advantages are broadly to be had, the scope of explicit services and products varies. For instance, a dental benefit would possibly come with preventive services and products handiest, similar to cleanings or x-rays, or extra complete protection, similar to crowns or dentures. Plans additionally range on the subject of charge sharing for more than a few services and products and bounds at the choice of services and products lined according to 12 months, many impose an annual greenback cap at the quantity the plan can pay towards lined carrier, and a few have networks of dental suppliers beneficiaries will have to make a choice from.

Enrollees in SNPs have higher get right of entry to than different Medicare Benefit enrollees to transportation (91% vs 44%), meal advantages (86% vs 78%), rest room protection gadgets (15% vs 10%), and in-home fortify services and products (31% vs 17%).

In comparison to 2022, an identical stocks of enrollees in person plans are in plans that supply eye assessments and/or eyeglass, listening to assessments and/or aids, health, telehealth, and dental care advantages. Rather higher stocks are in plans in 2023 than 2022 that supply over the counter drug advantages (84% in 2022 vs 90% in 2023), meal advantages (71% in 2022 vs 78% in 2023), transportation (39% in 2022 as opposed to 44% in 2023), and in-home fortify services and products (12% in 2022 vs 17% in 2023). The stocks of enrollees in SNPs that supply protection of dental services and products (96% in 2022 vs 88% in 2023) and over the counter advantages (96% in 2022 vs 84% in 2023) have reduced, whilst the proportion in plans that supply protection of in-home fortify services and products (20% in 2022 vs 31% in 2023) has larger.

As of 2020, Medicare Benefit plans had been allowed to incorporate telehealth advantages as a part of the fundamental Medicare Phase A and B receive advantages bundle – beyond what was allowed under traditional Medicare prior to the public health emergency. Those advantages are regarded as “telehealth” within the determine above, despite the fact that their charge will not be lined via both rebates or supplemental premiums. Medicare Benefit plans may additionally be offering supplemental telehealth advantages by means of far flung get right of entry to applied sciences and/or telemonitoring services and products, which can be utilized for the ones services and products that don’t meet the necessities for protection underneath conventional Medicare or the necessities for added telehealth advantages (such because the requirement of being lined via Medicare Phase B when equipped in-person). The vast majority of enrollees in each person plans and SNPs have get right of entry to to far flung get right of entry to applied sciences (73% and 82%, respectively), very similar to the stocks in 2022, however simply 4% of enrollees in person plans and a couple of% of enrollees in SNPs have get right of entry to to telemonitoring services and products.

Enrollees in SNPs are much more likely to be in plans that supply Particular Supplemental Advantages for the Chronically In poor health (SSBCI) than different Medicare Benefit enrollees.

Starting in 2020, Medicare Benefit plans have additionally been in a position to provide further advantages that don’t seem to be basically well being comparable for chronically sick beneficiaries, referred to as Particular Supplemental Advantages for the Chronically In poor health (SSBCI). The vast majority of person and SNP Medicare Benefit enrollees are in plans that don’t but be offering those advantages. Fewer than part of all SNP enrollees are in plans that supply some SSBCI. The proportion of Medicare Benefit enrollees who’ve get right of entry to to SSBCI advantages is best possible for meals and convey (15.8% for person plans and 41.4% for SNPs), normal helps for dwelling (e.g., housing, utilities) (11.7% in person plans and 29.2% for SNPs), transportation for non-medical wishes (10.7% for person plans and 25.7% for SNPs), and social wishes advantages (8.3% for person plans and 16.7% for SNPs) (Determine 5).

Just about all Medicare Benefit enrollees are in plans that require prior authorization for some services and products

Medicare Benefit plans can require enrollees to receive prior authorization ahead of a carrier shall be lined, and just about all Medicare Benefit enrollees (99%) are in plans that require prior authorization for some services and products in 2023. Prior authorization is maximum continuously required for fairly dear services and products, similar to Phase B medication (99%), professional nursing facility remains (99%), and inpatient clinic remains (acute: 98%; psychiatric: 93%), and is never required for preventive services and products (7%). Prior authorization may be required for almost all of enrollees for some further advantages (in plans that supply those advantages), together with complete dental services and products, listening to and eye assessments, and transportation. The choice of enrollees in plans that require prior authorization for a number of services and products stayed round the similar from 2022 to 2023. Against this to Medicare Benefit plans, conventional Medicare does now not typically require prior authorization for services and products and does now not require step treatment for Phase B medication.

7 in 10 Medicare Benefit enrollees are in plans that experience high quality scores of four or extra stars

For a few years, CMS has posted high quality scores of Medicare Benefit plans to offer beneficiaries with further details about plans introduced of their space. All plans are rated on a 1 to 5-star scale, with 1 famous person representing deficient efficiency, 3 stars representing reasonable efficiency, and 5 stars representing very good efficiency. CMS assigns high quality scores on the contract stage, fairly than for each and every person plan, that means that each and every plan lined underneath the similar contract receives the similar high quality score; maximum contracts quilt more than one plans. More than half (51%) of Medicare Benefit plans with a Prescription Drug Plan (MA-PDP) earned 4 stars or upper for his or her 2023 general score, with a mean score of four.15 stars throughout all contracts.

In 2023, 7 in 10 (71%) Medicare Benefit enrollees are in plans with a score of four or extra stars, a lower from 2022 (86%) (Determine 7). The lower within the proportion of enrollees in plans with a score of four or extra stars is in large part because of the expiration of measures in position all the way through the COVID-19 Public Well being Emergency. For instance, for some measures, in 2022, if the score on that measure was once not up to the prior 12 months, the scores reverted again to the 2021 price to carry plans innocuous. An extra 2 p.c of enrollees are in plans that weren’t rated as a result of they’re in a plan this is too new or has too low enrollment to obtain a score. Plans with 4 or extra stars and plans with out scores are eligible to obtain bonus payments for each and every enrollee the next plan 12 months. The famous person scores displayed within the determine above are what beneficiaries noticed once they selected a Medicare plan for 2023 and are other than what’s used to decide bonus bills.

In recent times, MedPAC has raised concerns concerning the famous person score gadget and high quality bonus program, together with that famous person scores are reported on the contract fairly than the plan stage, and will not be an invaluable indicator of high quality for beneficiaries as a result of they come with too many measures. Moreover, others have puzzled whether or not those insurance policies exacerbate racial disparities with out resulting in improvements to quality.

Dialogue

In 2023, as in prior years, nearly all of Medicare Benefit enrollees are in plans that don’t price a top rate and supply some further advantages and decreased affected person cost-sharing. Nearly all Medicare Benefit enrollees are in plans that impose prior authorization necessities for more than one services and products. Greater than 7 in 10 Medicare Benefit enrollees (73%) are in plans that don’t price a top rate (instead of the Phase B top rate), with the remainder quarter paying a mean top rate of about $57 monthly. Greater than 9 in 10 enrollees are in plans that still supply get right of entry to to numerous supplemental advantages, similar to eye assessments, dental and health advantages. Plans additionally range in on the subject of supplier networks and prescription drug advantages, which can be past the scope of this research, however are options folks would possibly imagine as they make their selections.

Plans are in a position to provide further advantages, continuously at no further charge to enrollees, as a result of they obtain an extra $2,350 according to enrollee above their estimated prices of offering Medicare-covered services and products. This portion of plan bills, also referred to as the rebate, has larger considerably within the ultimate a number of years, greater than doubling since 2018. Rebates have grown as a result of plan bids for his or her prices to offer Medicare-covered services and products have declined, whilst benchmarks (the utmost quantity CMS can pay plans) have remained well-above conventional Medicare spending (plans stay a portion of the adaptation between the benchmark and their bid, starting from 50% to 70% relying at the plan’s high quality ranking).

Whilst information on Medicare Benefit plan availability and enrollment and plan choices is strong, the similar cannot be said about carrier usage (particularly for supplemental advantages) and out-of-pocket spending patterns, which enable evaluation of the way effectively this system is assembly its targets on the subject of price and high quality and lend a hand Medicare beneficiaries evaluate protection choices. Moreover, there’s no publicly to be had information on how regularly supplemental advantages are utilized by enrollees or how a lot enrollees pay out-of-pocket for those services and products. As enrollment in Medicare Benefit and federal bills to personal plans keep growing, higher transparency and extra powerful data will change into more and more related for folks with Medicare program oversight.

Nancy Ochieng, Jeannie Fuglesten Biniek, Meredith Freed, and Tricia Neuman are with KFF. Anthony Damico is an unbiased marketing consultant

| This research makes use of information from the Facilities for Medicare & Medicaid Products and services (CMS) Medicare Benefit Enrollment, Receive advantages and Panorama recordsdata for the respective 12 months. Beginning in 2022, KFF is the usage of the Medicare Enrollment Dashboard for enrollment information, from March of each and every 12 months.

In earlier years, KFF had used the time period Medicare Benefit to confer with Medicare Benefit plans in addition to different varieties of personal plans, together with charge plans, PACE plans, and HCPPs. On the other hand, since 2022, KFF has excluded charge plans, PACE plans, HCPPs along with MMPs. We exclude those different plans as some will have other enrollment necessities than Medicare Benefit plans (e.g., is also to be had to beneficiaries with handiest Phase B protection) and in some instances, is also paid another way than Medicare Benefit plans. Those exclusions are mirrored in each present information in addition to information displayed trending again to 2010. |

[ad_2]

Source link