[ad_1]

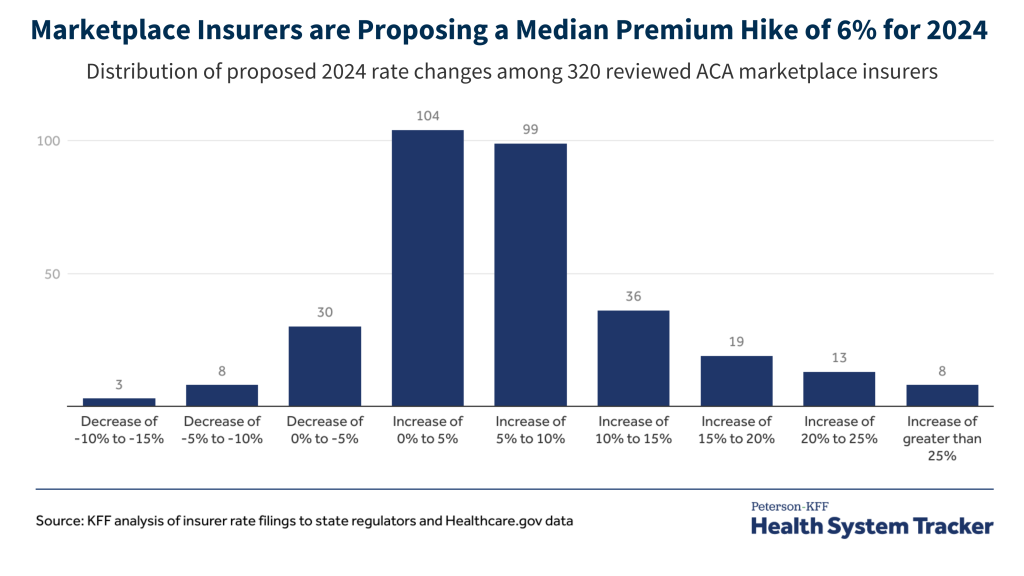

ACA Market insurers are asking for an average top class building up of 6% for 2024, in step with a new KFF analysis of the initial charge filings. Insurers’ proposed charge adjustments – maximum of which fall between 2% and 10% – might alternate all the way through the assessment procedure.

Despite the fact that maximum Market enrollees obtain subsidies and don’t seem to be anticipated to stand those added prices, top class will increase may just lead to upper federal spending on subsidies.

Insurers cite worth will increase for hospital treatment and pharmaceuticals as a key motive force of top class enlargement in 2024, in step with KFF’s exam of publicly-available paperwork from 58 insurers.

Along with inflation’s have an effect on on scientific prices, insurers level to enlargement within the usage of well being care, which fell in 2020 however has since returned to extra customary ranges.

In the meantime, the have an effect on of COVID-19-related prices on premiums stays a lot more unsure. Whilst one of the vital 320 ACA Market insurers be expecting vaccine commercialization to extend prices on a per-dose foundation, drops in COVID therapies and new charge sharing for checking out might decrease insurer prices and offset some enlargement in premiums.

A small collection of insurers cite different doable drivers of top class hikes, together with the unwinding of the Medicaid steady enrollment provision (which has already ended in the disenrollment of no less than 3.8 million other people from Medicaid) and new high-cost weight reduction medication.

The overall research and different knowledge on well being prices are accessible within the Peterson-KFF Health System Tracker, a web-based data hub devoted to tracking and assessing the efficiency of the U.S. well being device.

[ad_2]

Source link