[ad_1]

A new KFF analysis displays that the majority Medicare beneficiaries continue to exist reasonably low earning and feature modest monetary assets for retirement – posing a chance to their financial well-being, specifically in the event that they have been to have a significant, unanticipated expense, akin to a necessity for long-term nursing house care.

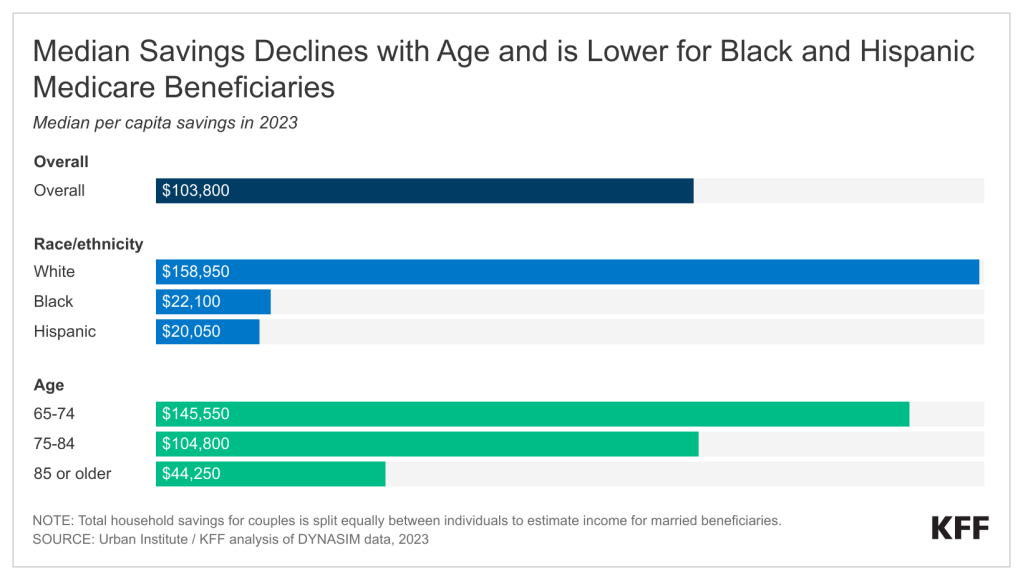

The monetary image is particularly bleak amongst Black and Hispanic Medicare beneficiaries, who generally tend to have decrease earning, financial savings, and residential fairness than White beneficiaries, the research displays. Girls have decrease earning and no more financial savings than males, and beneficiaries’ source of revenue and financial savings generally tend to say no with age.

Key takeaways from the research come with:

- General, 1 in 4 Medicare beneficiaries, or 16.3 million other people, lived on earning beneath $21,000 in step with individual in 2023, whilst part (32.6 million other people) lived on earning beneath $36,000 in step with individual. Median in step with capita source of revenue was once upper amongst White Medicare beneficiaries ($40,750) than amongst Black ($27,250) or Hispanic ($19,800) beneficiaries, and decrease amongst ladies than males ($33,750 vs. $38,950).

- One in 4 Medicare beneficiaries had financial savings beneath $16,950 in step with individual in 2023, whilst part had financial savings beneath $103,800 in step with individual. Ten p.c of seniors had no financial savings in any respect or have been in debt.

- Disparities in financial savings through race and ethnicity have been really extensive. Median financial savings amongst White beneficiaries ($158,950 in step with individual) was once greater than seven occasions upper than amongst Black beneficiaries ($22,100), and greater than 8 occasions upper than amongst Hispanic beneficiaries ($20,050). Multiple in 5 Black and Hispanic beneficiaries (22% and 21%) had no financial savings or have been in debt, in comparison to 7% of White beneficiaries.

Having restricted source of revenue and financial savings might turn out difficult for Medicare beneficiaries as they get older, specifically for older ladies, who generally tend to live much longer than males and is also much more likely to wish pricey long-term products and services and helps. Nationally, the median annual value of a personal room in a nursing house was once $108,405 in 2021 – greater than the typical Medicare beneficiary has in financial savings — and $54,000 for an assisted residing facility. (Medicare does now not quilt such care with the exception of in restricted instances. Some poorer beneficiaries may additionally qualify for Medicaid, the country’s number one payer for nursing house care.)

The total research of the source of revenue, belongings, and residential fairness of Medicare beneficiaries, total and through age, race and ethnicity, and gender, is available on kff.org. The research depends upon knowledge derived from the City Institute’s Dynamic Simulation of Source of revenue Fashion (DYNASIM4) for 2023.

[ad_2]

Source link