[ad_1]

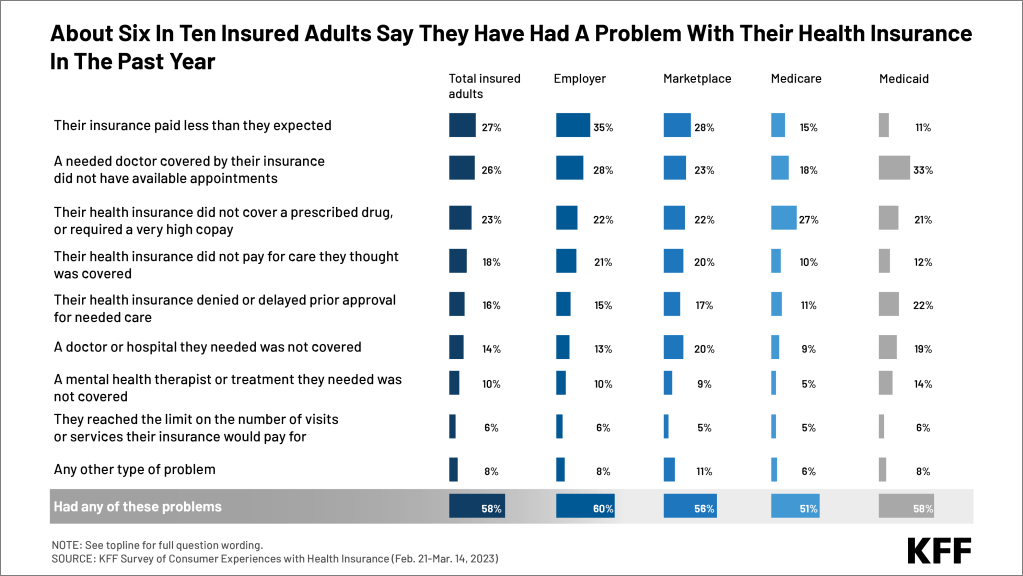

Maximum (58%) folks with medical health insurance say they encountered a minimum of one drawback the usage of their protection previously 12 months, with even higher stocks of folks with the best well being care wishes reporting such issues, reveals a new KFF survey of shopper reviews with medical health insurance.

Such issues range throughout sorts of insurance coverage however come with things like denied claims for care they idea was once coated, issue discovering an in-network physician or different supplier, and delays and denials of care that concerned an insurer’s prior authorization.

No less than part inside of every of 4 primary sorts of well being protection – employer, Medicaid, the Reasonably priced Care Act’s market, and Medicare – say they’d an issue the usage of their protection previously 12 months.

Such issues are extra not unusual amongst folks with better well being care wishes. As an example:

- Two-thirds (67%) of shoppers who fee their very own well being as “truthful” or “deficient” encountered an issue previously 12 months.

- About three-quarters (74%) of those that won psychological well being remedy previously 12 months reported an issue.

- Greater than three-quarters (78%) of those that won numerous well being care (greater than 10 supplier visits previously 12 months) reported an issue.

“The survey displays that the sheer complexity of insurance coverage is as large an issue as affordability, specifically for the ones with the best wishes,” KFF President and CEO Drew Altman stated. “Folks document a drawback process claims denials, restricted in-network suppliers, and a labyrinth of pink tape, with many pronouncing it avoided them from getting wanted care.”

Lately’s document captures key effects from the nationally consultant survey of three,605 folks with well being protection thru an employer, Medicare, Medicaid or the Reasonably priced Care Act’s marketplaces. Long run experiences will delve extra deeply into the reviews of folks with the ones sorts of protection, in addition to folks with particular power stipulations and desires throughout sorts of insurance coverage.

The frequency that individuals come upon particular insurance coverage issues varies via form of protection. As an example, folks with employer and market protection document denied claims extra continuously than folks with Medicare or Medicaid, and folks with Medicaid and market protection extra continuously document issues discovering in-network suppliers.

Insurance coverage issues can give a contribution to sudden prices, with greater than 1 / 4 (28%) of those that reported issues pronouncing they needed to pay extra for his or her care consequently. This contains a couple of 3rd of the ones with market or employer protection who reported issues previously 12 months.

Amongst those that reported fresh insurance coverage issues, part say they had been ready to unravel the problem to their pride, whilst just about as many say both that the problem were resolved in some way they didn’t like (28%) or that it remained unresolved (19%). Maximum insured adults (60%) have no idea they have got attraction rights via legislation, and 3 quarters (76%) have no idea what executive company to name for lend a hand coping with their insurance coverage.

Shoppers’ insurance coverage issues can impact their skill to get well timed, wanted care. Amongst the ones with fresh issues, about one in six say that they weren’t ready to get really helpful care (17%), they confronted a vital lengthen in receiving such care (17%), or their well being declined (15%) as an immediate consequence.

About part (51%) of insured adults document some issue figuring out a minimum of one facet in their medical health insurance, corresponding to what their insurance coverage will quilt (36%), what they are going to owe out-of-pocket for care (30%), or what their clarification of advantages remark way (30%). A couple of quarter say that they in finding it obscure phrases corresponding to “deductible” or “copay” (25%) and to determine which docs, hospitals and different suppliers are in community (23%).

Folks with Psychological Well being Demanding situations Have Extra Issues

The document additionally probes the demanding situations going through insured individuals who fee their psychological well being as truthful or deficient, without reference to whether or not they sought or acquired psychological well being remedy. This contains about one in 5 of all folks with insurance coverage, and one in 3 of the ones with Medicaid protection.

Really extensive stocks of enrollees on this crew fee the supply (45%) and high quality (37%) of psychological well being therapists and suppliers coated via their insurance coverage as “truthful” or “deficient.”

Amongst those that say their very own psychological well being is truthful or deficient, 43% say that there was once a time previously 12 months when they didn’t get wanted psychological well being care. Amongst younger adults underneath age 30 who describe their psychological well being as truthful or deficient, greater than part (55%) say they didn’t get wanted psychological well being care previously 12 months.

Folks cite quite a lot of causes for now not getting wanted psychological well being care, however insurance coverage was once an element for plenty of. Amongst all insured adults who didn’t get wanted psychological well being care, greater than 4 in 10 (44%) say they couldn’t manage to pay for the associated fee, and greater than a 3rd say it was once as a result of their insurance coverage wouldn’t quilt it.

- One in six (16%) of all insured folks say they have got had issues paying or an lack of ability to pay for clinical expenses previously 12 months, together with an identical stocks of the ones with market (19%), employer (17%), and Medicaid (16%) protection, in addition to 12 % of folks with Medicare.

- Premiums additionally may also be a topic for shoppers, specifically for the ones with employer and market plans. About part of the ones with market or employer protection give their insurance coverage plan low marks for the quantity that they pay in premiums and the quantity they pay out-of-pocket to look a physician. A long way fewer of the ones with Medicare or Medicaid fee the ones facets in their protection negatively.

- Despite the issues folks document the usage of their insurance coverage, a big majority (81%) give “superb” or “just right” scores when requested to fee their insurance coverage general.

- Huge majorities of shoppers with insurance coverage say they’d enhance necessities on insurers that might show you how to keep away from or unravel insurance coverage issues. Those come with necessities to care for correct and up-to-date details about who’s of their community (91%) and to offer more practical, easier-to learn statements explaining protection choices and find out how to attraction should you disagree (94%), all of that have been enacted via Congress despite the fact that now not all had been carried out.

Designed and analyzed via public opinion researchers at KFF, the KFF Survey of Shoppers Stories with Well being Insurance coverage was once carried out February 21-March 14, 2023, on-line and via phone amongst a consultant pattern of three,605 adults within the U.S. with medical health insurance protection, together with 978 adults with employer-sponsored insurance coverage, 815 adults with Medicaid protection, 885 adults with Medicare, and 880 adults with market insurance coverage. Interviews had been carried out in English and in Spanish. The margin of sampling error is plus or minus 2 proportion issues for the overall pattern. For effects in line with subgroups, the margin of sampling error could also be upper.

[ad_2]

Source link