[ad_1]

Medicare Section D is a voluntary outpatient prescription drug get advantages for other people with Medicare supplied thru personal plans that contract with the government. Beneficiaries can select to join both a stand-alone prescription drug plan (PDP) to complement conventional Medicare or a Medicare Advantage plan, principally HMOs and PPOs, that gives all Medicare-covered advantages, together with prescribed drugs (MA-PD). In 2023, more than 50 million of the 65 million other people coated by way of Medicare are enrolled in Section D plans. This truth sheet supplies an outline of the Medicare Section D program, plan availability, enrollment, and spending and financing, in line with knowledge from the Facilities for Medicare & Medicaid Services and products (CMS), the Congressional Price range Administrative center (CBO), and different resources. It additionally supplies an outline of adjustments to the Section D get advantages in line with provisions in the Inflation Reduction Act.

Medicare Prescription Drug Plan Availability in 2024

In 2024, 709 PDPs can be introduced around the 34 PDP areas national (except the territories), an 11% lower from 2023 and the bottom selection of PDPs to be had for the reason that Section D program’s starting in 2006 (Determine 1). Whilst the provision of stand-alone PDPs has been trending downward through the years, together with a decline in PDP enrollment, the availability of Medicare Advantage drug plans has been increasing swiftly, and extra other people in Medicare are actually getting Section D drug protection thru Medicare Benefit plans.

In spite of the total aid within the selection of PDPs in 2024, beneficiaries in every state can have a selection of more than one stand-alone PDPs, starting from 15 PDPs in New York to 24 PDPs in Alabama and Tennessee (Determine 2). As well as, beneficiaries can be ready to choose between amongst many MA-PDs to be had on the native degree.

Low-Source of revenue Subsidy Plan Availability in 2024

Beneficiaries with low incomes and modest assets are eligible for help with Section D plan premiums and price sharing. During the Section D Low-Source of revenue Subsidy (LIS) program, further top rate and cost-sharing help is to be had for Section D enrollees with low earning (lower than 150% of poverty, or $21,870 for people/$29,580 for married {couples} in 2023) and modest property (as much as $16,660 for people/$33,240 for {couples} in 2023). As of 2024, any person who qualifies for the LIS program will obtain complete advantages, below a provision of the Inflation Relief Act; in earlier years, other people with earning between 135% and 150% of poverty won partial LIS advantages.

In comparison to 2023, fewer plans can be to be had for enrollment of LIS beneficiaries for no top rate in 2024 – 126 plans, a 34% aid in comparison to 2023 (Determine 3). Not up to one-fifth (18%) of PDPs in 2024 are benchmark plans.

Some enrollees have fewer benchmark plan choices than others as a result of benchmark plan availability varies on the Section D area degree. The selection of premium-free PDPs in 2023 levels throughout states from 2 plans in 8 states (Florida, Illinois, Missouri, Nevada, New Jersey, New York, Ohio, and Texas) to 7 plans in 1 state (Wisconsin) (Determine 4). LIS enrollees can make a choice any plan introduced of their house, but when they’re enrolled in a non-benchmark plan, they could also be required to pay some portion in their plan’s per 30 days top rate.

Section D Plan Premiums and Advantages in 2024

Premiums

The 2024 Section D base beneficiary top rate – which is in line with bids submitted by way of each PDPs and MA-PDs and isn’t weighted by way of enrollment – is $34.70, a 6% build up from 2023. Between 2024 and 2029, annual enlargement within the base beneficiary top rate is capped at 6% because of the premium stabilization provision within the Inflation Relief Act. Absent this provision, the 2024 base beneficiary top rate would have greater by way of 20% to $39.35, reflecting the next moderate plan bid for providing Section D protection in 2024 in comparison to 2023.

The bottom beneficiary top rate isn’t the similar as the quantity that Section D enrollees pay for protection, and enrollees might see their top rate build up by way of greater than 6% (or much less, and even lower) in the event that they keep in the similar plan for 2024. Exact per 30 days premiums paid by way of Section D enrollees range significantly. In 2024, PDP per 30 days premiums vary from $0 (or lower than $1) for a PDP to be had national to just about $200 for a PDP to be had in Pennsylvania and West Virginia (unweighted by way of plan enrollment). Along with the per 30 days top rate, Section D enrollees with upper earning ($103,000/person; $206,000/couple) pay an income-related premium surcharge, starting from $12.90 to $81.00 per thirty days in 2024 (relying on revenue). For protection in MA-PDs, most enrollees in 2023 pay no premium, past the per 30 days Section B top rate (even though high-income MA enrollees are required to pay a top rate surcharge).

Advantages

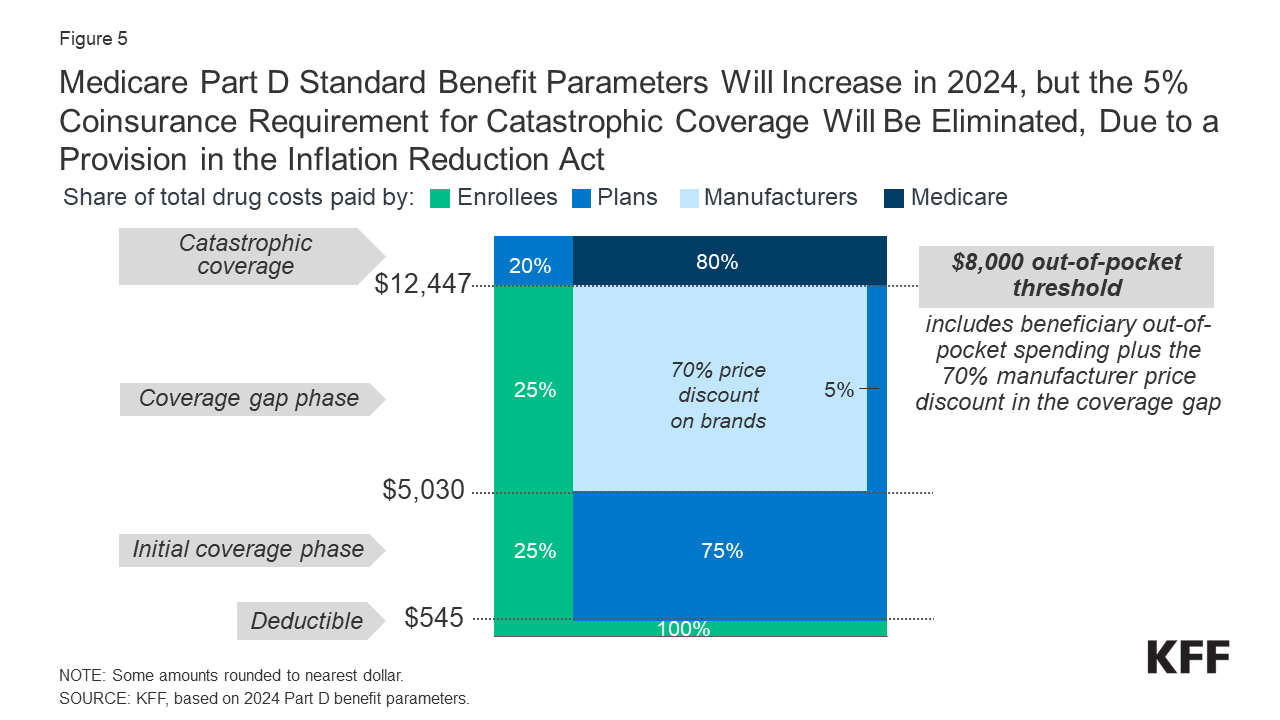

The Section D outlined same old get advantages has a number of levels, together with a deductible, an preliminary protection segment, a protection hole segment, and catastrophic protection. Between 2023 and 2024, the parameters of the standard benefit are rising, this means that Section D enrollees will face upper out-of-pocket prices for the deductible and within the preliminary protection segment, as they’ve in prior years, and must pay extra out-of-pocket earlier than qualifying for catastrophic protection.

In a metamorphosis from prior years, on the other hand, beneficiaries in 2024 will now not pay 5% coinsurance after they qualify for catastrophic protection, because of a provision within the Inflation Relief Act that eradicated this cost-sharing requirement.

The usual get advantages quantities are listed to switch once a year in line with the speed of Section D in line with capita spending enlargement, and, aside from for 2014, have greater every yr since 2006 (Determine 5):

- The usual deductible is expanding from $505 in 2023 to $545 in 2024.

- The preliminary protection restrict is expanding from $4,660 to $5,030.

- The out-of-pocket spending threshold is expanding from $7,400 to $8,000 (an identical to $12,447 in general drug spending in 2024, up from $11,206 in 2023). This quantity comprises what beneficiaries themselves pay out of pocket plus the worth of the producer cut price on the cost of brand-name medication within the protection hole segment. In response to the $8,000 catastrophic threshold for 2024, enrollees themselves can pay about $3,300 out of pocket earlier than achieving the catastrophic segment (this estimate is in line with the use of model medication solely).

Determine 5: Medicare Section D Usual Receive advantages Parameters Will Building up in 2024, however the 5% Coinsurance Requirement for Catastrophic Protection Will Be Eradicated, Because of a Provision within the Inflation Relief Act

For prices within the protection hole segment, beneficiaries pay 25% for each brand-name and generic medication, with producers offering a 70% cut price on manufacturers and plans paying the remainder 5% of brand name drug prices and the remainder 75% of generic drug prices. For general drug prices above the catastrophic threshold in 2024, Medicare can pay 80% and plans can pay 20%.

Section D plans should be offering both the outlined same old get advantages or an alternate equivalent in price (“actuarially an identical”) and too can supply enhanced advantages. Each fundamental and enhanced get advantages plans range relating to their particular get advantages design, protection, and prices, together with deductibles, cost-sharing quantities, usage control gear (i.e., prior authorization, amount limits, and step remedy), and formularies (i.e., coated medication). Plan formularies should come with drug categories overlaying all illness states, and at least two chemically distinct medication in every elegance. Section D plans are required to hide all medication in six so-called “secure” categories: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

Adjustments to Section D Beneath the Inflation Relief Act

With the passage of the Inflation Relief Act, which incorporates several provisions to lower prescription drug spending by way of Medicare and beneficiaries, main adjustments are coming to the Medicare Section D program. Those provisions began to take impact in 2023 and can proceed phasing in over the following couple of years. The regulation:

- Limits the cost of insulin merchandise to not more than $35 per thirty days in all Section D plans and makes grownup vaccines coated below Section D to be had without spending a dime, as of 2023.

- Calls for drug producers to pay a rebate to the government if costs for medication coated below Section D and Section B build up quicker than the speed of inflation, with the preliminary duration for measuring Section D drug worth will increase operating from October 2022-September 2023.

- Expands eligibility for complete advantages below the Section D Low-Source of revenue Subsidy program in 2024.

- Provides a difficult cap on out-of-pocket drug spending below Section D by way of getting rid of the 5% coinsurance requirement for catastrophic protection in 2024 and capping out-of-pocket spending at $2,000 in 2025.

- Shifts extra of the accountability for catastrophic protection prices to Section D plans and drug producers, beginning in 2025.

- Authorizes the Secretary of the Division of Well being and Human Services and products to negotiate the price of some drugs covered under Medicare, with negotiated costs first to be had for 10 Section D medication in 2026.

CBO estimates that taken altogether, the drug pricing provisions within the regulation will cut back the federal deficit by way of $237 billion over 10 years (2022-2031).

Section D and Low-Source of revenue Subsidy Enrollment in PDPs and MA-PDs

Enrollment in Medicare Section D plans is voluntary, aside from for beneficiaries who’re eligible for each Medicare and Medicaid and sure different low-income beneficiaries who’re robotically enrolled in a PDP if they don’t select a plan on their very own. Except beneficiaries have drug protection from some other supply this is no less than as just right as same old Section D protection (“creditable protection”), they face a penalty equivalent to one% of the nationwide moderate top rate for every month they extend enrollment.

In 2023, 50.5 million Medicare beneficiaries are enrolled in Medicare Section D plans, together with employer-only team plans; of the whole, 56% are enrolled in MA-PDs and 44% are enrolled in stand-alone PDPs (Determine 6). Some other 0.9 million beneficiaries are estimated to have drug protection thru employer-sponsored retiree plans the place the employer receives a subsidy from the government equivalent to twenty-eight% of drug bills between $545 and $11,200 in line with retiree (in 2024). A number of million beneficiaries are estimated to produce other resources of drug protection, together with employer plans for lively staff, FEHBP, TRICARE, and Veterans Affairs (VA). Around 12% of people with Medicare are estimated to lack creditable drug protection.

In 2023, 13.4 million Part D enrollees obtain top rate and cost-sharing help during the LIS program. Beneficiaries who’re dually eligible, QMBs, SLMBs, QIs, and SSI-onlys robotically qualify for the extra help, and Medicare robotically enrolls them into PDPs with premiums at or beneath the regional moderate (the Low-Source of revenue Subsidy benchmark) if they don’t select a plan on their very own. Different beneficiaries are topic to each an revenue and asset take a look at and wish to practice for the Low-Source of revenue Subsidy thru both the Social Safety Management or Medicaid.

Section D Spending and Financing

Section D Spending

The Congressional Price range Administrative center (CBO) estimates that spending on Section D advantages will general $120 billion in 2024, representing 14% of web Medicare outlays (web of offsetting receipts from premiums and state transfers). Section D spending relies on a number of elements, together with the whole selection of Section D enrollees, their well being standing and the volume and form of medication used, the selection of high-cost enrollees (the ones with drug spending above the catastrophic threshold), the selection of enrollees receiving the Low-Source of revenue Subsidy, and the facility of plan sponsors to barter reductions (rebates) with drug firms and most well-liked pricing preparations with pharmacies, and to regulate use (e.g., selling use of generic medication, prior authorization, step remedy, amount limits, and mail order).

Section D Financing

Financing for Part D comes from common revenues (74%), beneficiary premiums (14%), and state contributions (11%). The per 30 days top rate paid by way of enrollees is ready to hide 25.5% of the price of same old drug protection. Medicare subsidizes the rest, in line with bids submitted by way of plans for his or her anticipated get advantages bills. Upper-income Section D enrollees pay a bigger percentage of same old Section D prices, starting from 35% to 85%, relying on revenue.

Bills to Plans

For 2024, Medicare’s actuaries estimate that Section D plans will obtain direct subsidy bills averaging $383 in line with enrollee general, $2,588 for enrollees receiving the LIS, and $1,153 in reinsurance bills for terribly high-cost enrollees; employers are anticipated to obtain, on moderate, $591 for retirees in employer-subsidy plans. Section D plans additionally obtain further risk-adjusted bills in line with the well being standing in their enrollees, and plans’ possible general losses or features are restricted by way of risk-sharing preparations with the government (“threat corridors”).

In 2024, as in earlier years, Medicare’s reinsurance bills to plans subsidize 80% of general drug spending incurred by way of Section D enrollees above the catastrophic protection threshold. (This percentage will drop to twenty% for brand-name medication and 40% for generic medication, starting in 2025, because of a provision within the Inflation Relief Act.) Within the mixture, Medicare’s reinsurance bills to Section D plans now account for on the subject of part of general Section D spending (48%), up from 14% in 2006 (expanding from $6 billion in 2006 to $57 billion in 2022) (Determine 7). Upper get advantages spending above the catastrophic threshold is a results of a number of elements, together with an build up within the selection of high-cost medication, drug worth will increase, and a metamorphosis made by way of the ACA to rely the producer cut price on the cost of brand-name medication within the protection hole in opposition to the out-of-pocket threshold for catastrophic protection; this modification has resulted in more Part D enrollees with spending above the catastrophic threshold over time.

Problems for the Long term

Since its inception, the Medicare drug get advantages has helped to restrict enlargement in moderate out-of-pocket drug spending by way of Medicare beneficiaries enrolled in Section D plans. Extra lately, on the other hand, a mixture of things, together with emerging drug costs, extra plans charging coinsurance rather than flat copayments for coated brand-name medication, and annual will increase within the out-of-pocket spending threshold, has greater the out-of-pocket charge burden confronted by way of some enrollees, particularly the ones with excessive drug prices.

Provisions within the Inflation Relief Act that began rolling out as of 2023 are designed to deal with a number of considerations associated with Section D, together with the loss of a difficult cap on out-of-pocket spending for Section D enrollees; the shortcoming of the government to barter drug costs with producers; the numerous build up in Medicare spending for Section D enrollees with excessive drug prices; costs for plenty of Section D coated medication emerging quicker than the speed of inflation; and the rather vulnerable monetary incentives confronted by way of Section D plan sponsors to regulate excessive drug prices.

Contemporary years have observed a rising divide within the Section D plan marketplace between stand-alone PDPs, the place the selection of plans has most often been trending downward through the years along with a discount in PDP enrollment, and MA-PDs, the place plan availability and enrollment have skilled stable enlargement. MA-PD sponsors can use rebate dollars from Medicare payments to lower or eliminate their Part D premiums, so the common top rate for drug protection in MA-PDs is closely weighted by way of zero-premium plans. In 2023, the common per 30 days PDP top rate is considerably upper than the enrollment-weighted moderate per 30 days portion of the top rate for drug protection in MA-PDs ($40 vs. $10). This top rate imbalance between PDPs and MA-PDs might be exacerbated as plans suppose higher legal responsibility for prime drug prices above the catastrophic threshold in 2024 and 2025. The expanding availability of low or zero-premium MA-PDs, whilst PDPs price considerably upper premiums, may just tilt enrollment much more in opposition to Medicare Benefit plans at some point. And whilst provisions within the Inflation Relief Act to make the Section D get advantages extra beneficiant will assist enrollees, particularly the ones with excessive drug prices, they might additionally make it more difficult for some plan sponsors to proceed to provide competitively priced protection, in particular sponsors of stand-alone drug plans.

Figuring out how smartly Section D continues to fulfill the desires of other people on Medicare because the quite a lot of provisions of the Inflation Relief Act are applied can be knowledgeable by way of ongoing research of the Section D plan market, formulary protection and prices for brand spanking new and present drugs, and tendencies in Medicare beneficiaries’ out-of-pocket drug spending.

[ad_2]

Source link