[ad_1]

Medicare supplies medical health insurance protection to 65 million folks within the U.S., together with 57 million older adults and just about 8 million more youthful adults with disabilities. Protection of Medicare advantages is supplied via both conventional Medicare or Medicare Merit personal plans. Many of us with Medicare additionally produce other protection, reminiscent of Medicaid, Medigap, and employer protection, which might pay some or all in their Medicare cost-sharing necessities and may additionally supply advantages that Medicare does now not duvet. This temporary analyzes the various kinds of protection that individuals with Medicare have and the demographic traits of Medicare beneficiaries with those other protection varieties, according to knowledge from the 2020 Medicare Present Beneficiary Survey (see Methods for main points).

This snapshot of protection highlights that most of the people with Medicare have some form of protection that can offer protection to them from limitless out-of-pocket prices and might be offering further advantages, whether or not it’s protection along with conventional Medicare or protection from Medicare Merit plans, which might be required to have an out-of-pocket cap and normally be offering supplemental advantages. Then again, with regards to 5 million folks with Medicare, most commonly low to modest-income beneficiaries, haven’t any further protection, which puts them susceptible to dealing with prime out-of-pocket spending or going with out wanted hospital therapy because of prices.

Resources of Protection

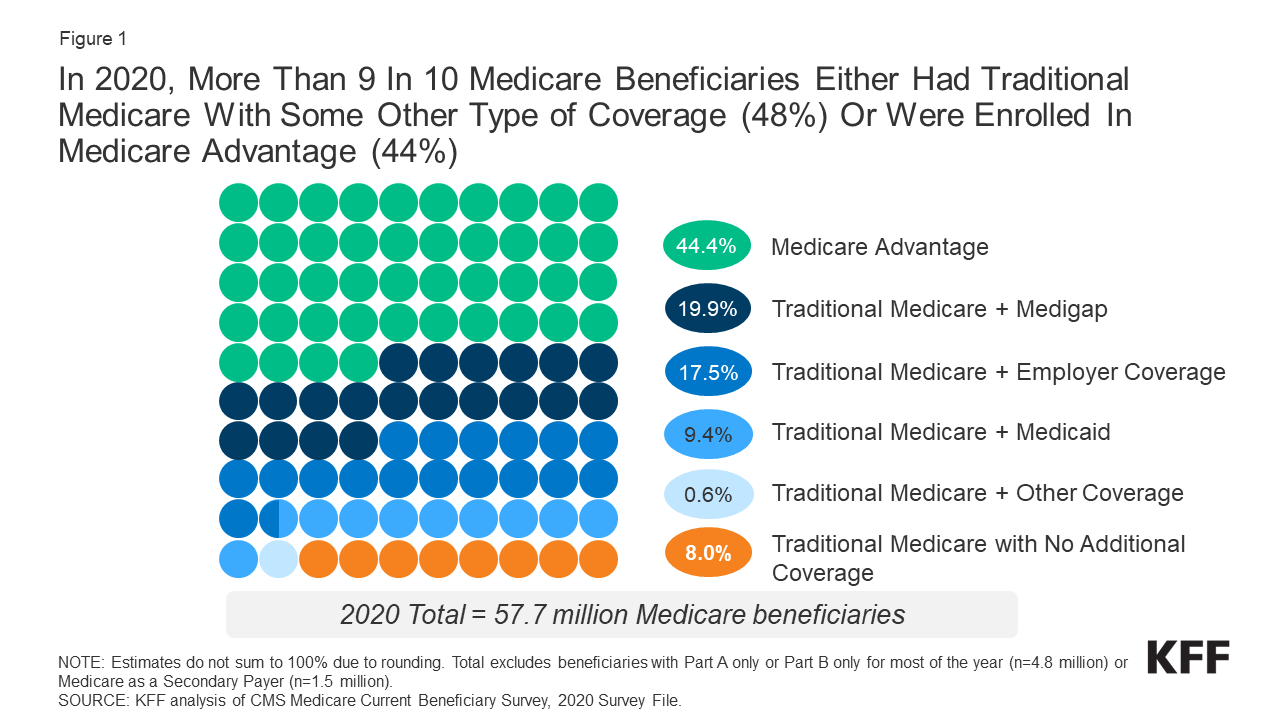

Greater than 9 in 10 folks with Medicare both had conventional Medicare coupled with every other form of protection (48%), reminiscent of Medigap, employer protection, and Medicaid, or had been enrolled in Medicare Merit plans (44%) in 2020 (Determine 1). Just about 1 in 10 Medicare beneficiaries (8%) – 4.6 million folks – had been coated beneath conventional Medicare however had no further protection.

Determine 1: In 2020, Extra Than 9 In 10 Medicare Beneficiaries Both Had Conventional Medicare With Some Different Form of Protection (48%) Or Had been Enrolled In Medicare Merit (44%)

Traits of Medicare Beneficiaries, Through Supply of Protection

Conventional Medicare

Amongst Medicare beneficiaries in conventional Medicare, maximum (86%) had some form of further protection in 2020, both via Medigap (36%), employer protection (31%), Medicaid (17%), or some other supply (1%). However 1 in 7 (14%) Medicare beneficiaries in conventional Medicare had no further protection (Determine 2, Appendix Table 1). A extra detailed dialogue of a majority of these protection and the traits of folks coated by way of every is underneath.

Medigap

Medicare complement insurance coverage, often referred to as Medigap, coated 2 in 10 (20%) Medicare beneficiaries general, or 36% of the ones in conventional Medicare (11.5 million beneficiaries) in 2020. Medigap policies, offered by way of personal insurance coverage corporations, absolutely or partly duvet Medicare Section A and Section B cost-sharing necessities, together with deductibles, copayments, and coinsurance. Medigap limits the monetary publicity of Medicare beneficiaries and offers coverage towards catastrophic clinical bills, however Medigap premiums can be costly and will upward thrust with age, amongst different elements, relying at the state during which they’re regulated.

In comparison to all conventional Medicare beneficiaries in 2020, beneficiaries with Medigap had been much more likely to be White, have annual earning of $40,000 or extra in line with individual, self-report superb, excellent, or just right well being, and feature a bachelor’s level or upper (Determine 3, Appendix Table 1). Just a small percentage of folks with Medigap (2%) had been beneath age 65 (who qualify for Medicare according to having long-term disabilities), in comparison to 13% within the general conventional Medicare inhabitants. Federal legislation supplies a 6-month ensure factor coverage for adults ages 65 and older once they first join in Medicare Section B in the event that they need to acquire a supplemental Medigap coverage, however those protections don’t lengthen to adults beneath the age of 65, who qualify for Medicare because of having a long-term incapacity. Most states don’t require insurers to factor Medigap insurance policies to beneficiaries beneath age 65, and maximum don’t lengthen ensure factor protections to folks over age 65 past the one-time Medigap open enrollment period.

Employer Protection

In general, 15.5 million Medicare beneficiaries – greater than 1 / 4 (27%) of Medicare beneficiaries general – additionally had some type of employer medical health insurance protection in 2020. Of the full choice of beneficiaries with employer protection, 10.1 million beneficiaries had this protection along with conventional Medicare (31% of beneficiaries in conventional Medicare), whilst 5.4 million beneficiaries had been enrolled in Medicare Merit employer team plans (see Medicare Merit segment underneath).

Folks with each Medicare and employer- or union-sponsored protection come with retirees, for whom Medicare is number one, and energetic employees (or folks whose spouses are energetic employees), for whom Medicare is secondary. In 2020, an estimated 5.2 million Medicare beneficiaries had Section A most effective, suggesting that they or their partner had been energetic employees and had number one protection from an employer plan. Folks with Section A most effective can not join in a Medicare Merit plan, so folks with protection via Medicare Merit employer team plans usually are retired.

In comparison to conventional Medicare beneficiaries general in 2020, beneficiaries with employer protection along with conventional Medicare had been much more likely to have earning of $40,000 or better in line with individual, a bachelor’s level or upper, self-report superb or just right well being, haven’t any barriers in actions of day by day dwelling (ADLs), and had been much less prone to be beneath age 65 (Determine 3, Appendix Table 1).

Medicaid

Medicaid, the federal-state program that gives well being and long-term services and products and helps protection to low-income folks, used to be a supply of protection for almost 10.7 million Medicare beneficiaries with low earning and modest property in 2020, or 19% of all Medicare beneficiaries. (Estimates on this research fluctuate from estimates printed in a separate KFF analysis because of other knowledge assets used; see Methods underneath for main points.) Of this general, 5.4 million folks had been enrolled in each conventional Medicare and Medicaid (17% of all beneficiaries in conventional Medicare), whilst 5.3 million folks had been enrolled in Medicare Merit plans and Medicaid (see Medicare Merit segment underneath) (Appendix Table 1). For those beneficiaries, known as dual-eligible folks, Medicaid normally will pay the Medicare Section B top rate and may additionally pay a portion of Medicare deductibles and different cost-sharing necessities. Most dual-eligible persons are additionally eligible for complete Medicaid advantages, together with long-term services and products and helps. Twin-eligible people who don’t seem to be eligible for complete Medicaid advantages obtain partial advantages, together with help with Medicare premiums and, in lots of however now not all circumstances, Medicare cost-sharing necessities.

In comparison to conventional Medicare beneficiaries general in 2020, dual-eligible folks had been much more likely to be beneath the age of 65, have low earning and somewhat low training ranges, and determine as Black or Hispanic (Determine 3, Appendix Table 1).

No Further Protection

In 2020, just about 1 in 10 Medicare beneficiaries general (8%, or 4.6 million) had no different insurance policy along with conventional Medicare. Conventional Medicare beneficiaries with out a further protection (1 in 7 of the ones in conventional Medicare, or 14%) are absolutely uncovered to Medicare’s cost-sharing necessities, which might imply paying a $1,600 deductible for a clinic keep in 2023, day by day copayments for prolonged clinic and professional nursing facility remains, and a $226 deductible plus 20% coinsurance for doctor visits and different outpatient services and products. (Those prices are along with just about $2,000 for the usual Section B top rate for all of 2023). Beneficiaries in conventional Medicare with out further protection additionally face the chance of prime annual out-of-pocket prices as a result of there’s no cap on out-of-pocket spending for Section A and B services and products in conventional Medicare, in contrast to in Medicare Merit plans.

In comparison to conventional Medicare beneficiaries general in 2020, beneficiaries in conventional Medicare with out a further protection had been much more likely to have annual earning between $20,000 and $40,000 in line with individual, to be beneath the age of 65, and to be male (Determine 3, Appendix Table 1).

Medicare Merit

In 2020, Medicare Merit coated greater than 4 in 10 Medicare beneficiaries (44%), or 25.7 million folks with Medicare. (The quantity and percentage of Medicare Merit enrollees has higher since 2020, up to 30.8 million in 2023, or 51% of all eligible beneficiaries.)

Of the full choice of Medicare Merit enrollees in 2020, 5.4 million (21%) had been enrolled in team employer- or union-sponsored plans for (referred to as employer team waiver plans, or EGWPs). Underneath those preparations, employers or unions contract with an insurer and Medicare will pay the insurer a hard and fast quantity in line with enrollee to supply advantages coated by way of Medicare. The employer or union (and infrequently the enrollee) may additionally pay a top rate for extra advantages or cheaper price sharing.

Some other 5.3 million Medicare Merit enrollees in 2020 (21%) also had Medicaid coverage, and had been enrolled in both a Special Needs Plan (SNP) or a Medicare Merit plan in most cases to be had to all Medicare beneficiaries. SNPs prohibit enrollment to precise kinds of beneficiaries with important or somewhat specialised care wishes, together with beneficiaries dually eligible for Medicare and Medicaid (D-SNPs), folks with critical persistent or disabling stipulations (C-SNPs), and beneficiaries requiring a nursing house or institutional degree of care (I-SNPs).

In comparison to conventional Medicare beneficiaries in 2020, Medicare Merit enrollees had been much more likely to be Black or Hispanic, have earning underneath $40,000 in line with individual, are living in city spaces, and feature decrease ranges of training (Determine 4, Appendix Table 1).

| This research is according to knowledge from the Facilities for Medicare & Medicaid Products and services 2020 Medicare Present Beneficiary Survey (MCBS), the latest 12 months to be had. Resources of supplemental protection are made up our minds according to the supply of protection held for probably the most months of Medicare enrollment in 2020. The research comprises 57.7 million folks with Medicare in 2020 (weighted), together with beneficiaries dwelling locally and in amenities, except for beneficiaries who had been enrolled in Section A most effective or Section B just for maximum in their Medicare enrollment in 2020 (weighted n=4.8 million) and beneficiaries who had Medicare as a secondary payer (weighted n=1.5 million). The research additionally focuses most effective on protection for Section A and Section B advantages, now not Section D. This research of the MCBS accounted for the complicated sampling design of the survey.

The choice of beneficiaries enrolled in each Medicare and Medicaid (or dual-eligible folks) (10.7 million) on this temporary does now not align with estimates printed in a separate KFF analysis because of variations in knowledge assets used. The separate KFF research related MCBS knowledge with Power Situation Warehouse (CCW) knowledge. On this temporary, the research is restricted to MCBS since the MCBS supplies a much broader array of demographic and well being standing signs than CCW. Moreover, it isn’t conceivable to spot all assets of supplemental protection within the CCW, together with employer-sponsored insurance coverage and Medigap. All reported variations within the textual content are statistically important; effects from all statistical checks had been reported with p<0.05 thought to be statistically important. As a result of estimates reported within the textual content and figures are rounded to the closest complete quantity, some estimates would possibly not sum to general totals because of rounding. |

[ad_2]

Source link